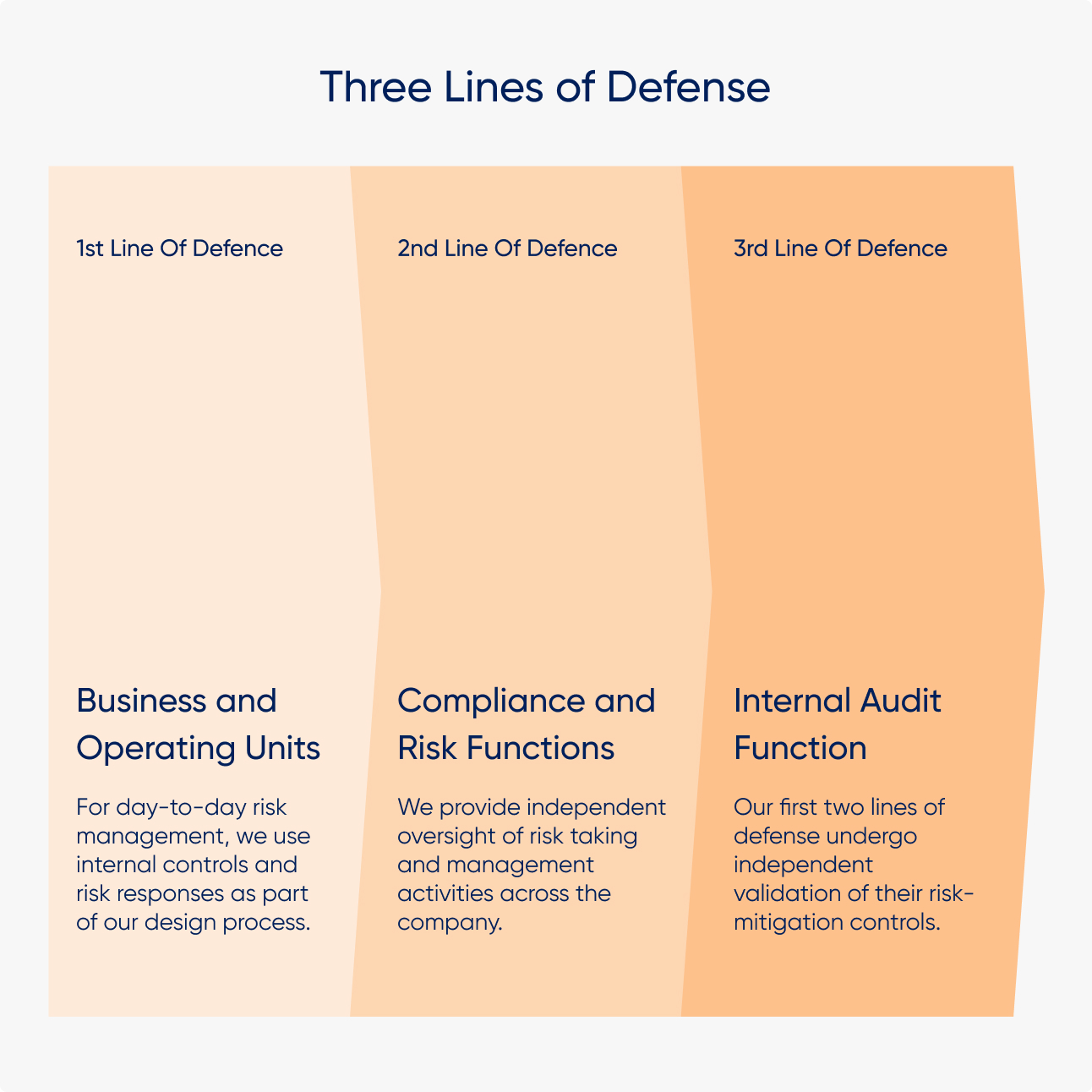

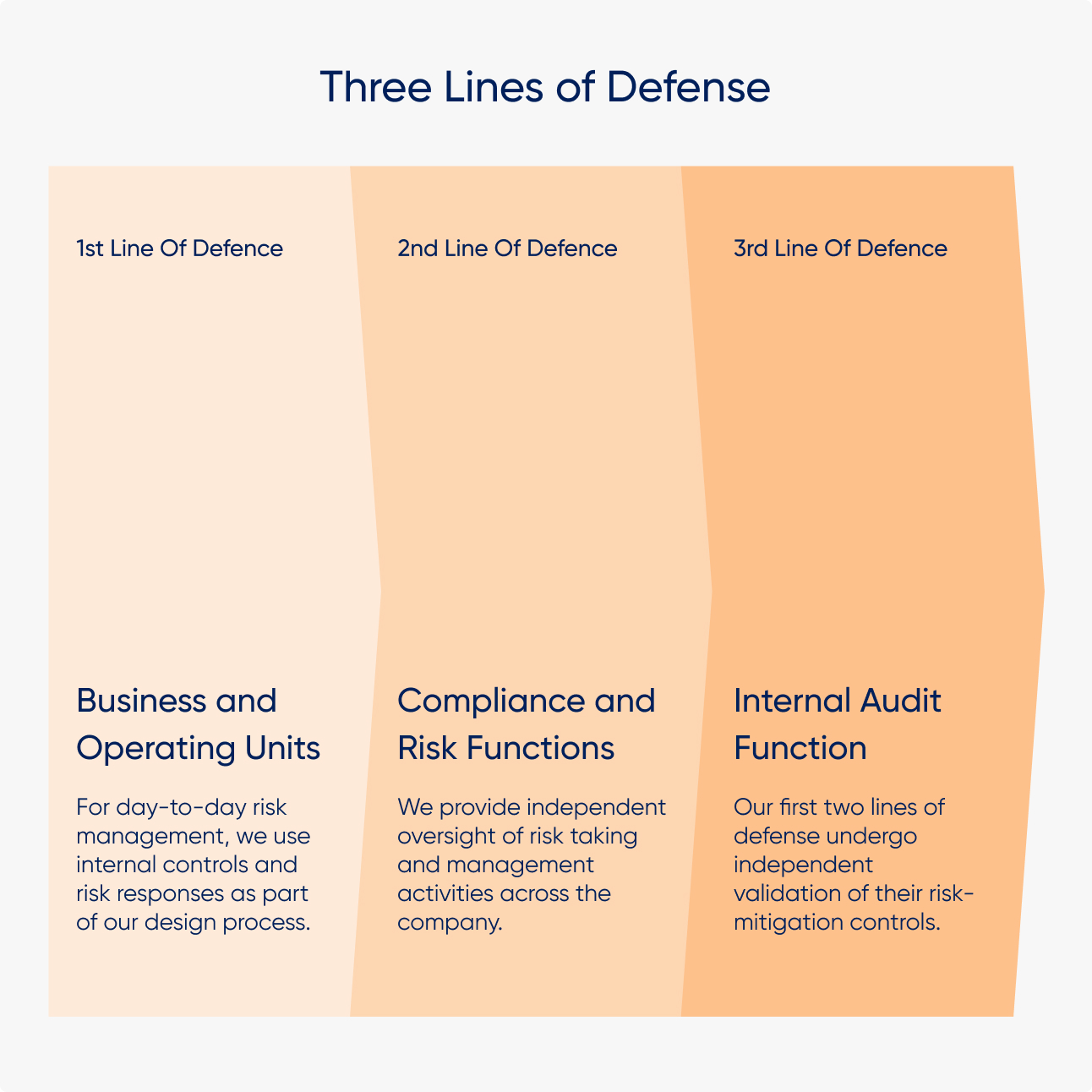

We have a robust three-lines-of-defense model that underpins our governance and risk management framework. Our enterprise risk management (ERM) framework aligns with our strategic objectives and is designed to ensure appropriate and independent checks and balances that reconcile business interests with risk management considerations.

Using this model, we effectively identify, assess, manage, and report risks. We frequently review our risk appetite alongside our annual business planning cycles and set corresponding risk tolerances to translate them into specific limits for business and operational units.

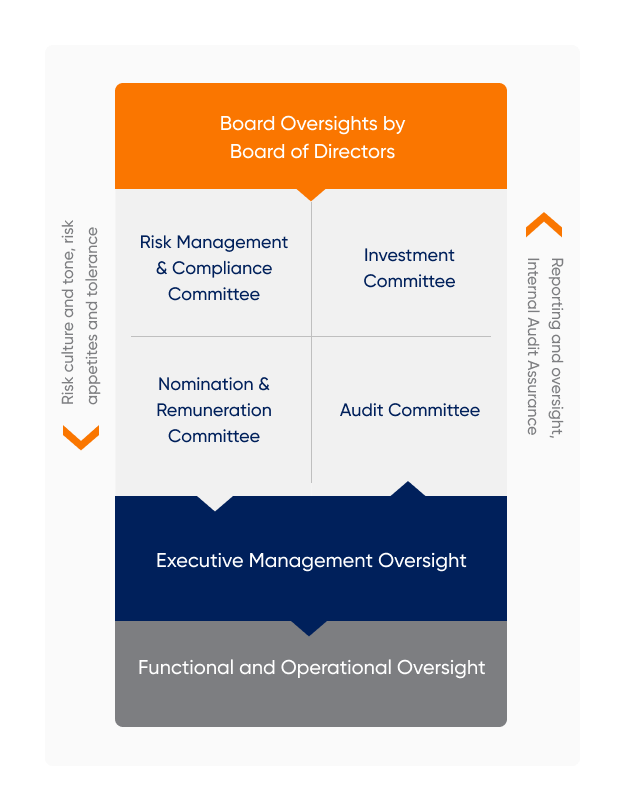

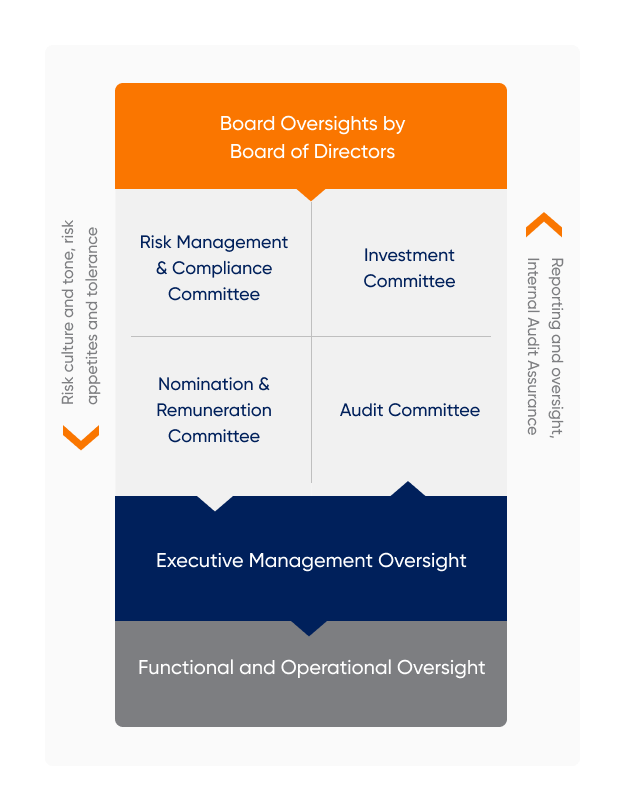

Peak Re has established a robust governance system that aligns with applicable laws and regulations as well as international best practices and is tailored to the nature, scale, and complexities inherent in our business risks.

Peak Re’s governance structure defines the responsibilities and authorities of the Board and its committees which is ultimately accountable for oversight of risk management in the Company. Together with the Executive Committee, the Board of Directors sets the tone from the top and fosters a compliant risk culture. The Chief Risk Officer is responsible for ongoing evaluation and management of the organization’s risks and overseeing the risk culture.

Peak Re’s Board is comprised of 3 independent non-executive directors (INEDs), 3 non-executive directors and 2 executive directors. All Peak Re committees are chaired by INEDs to ensure effective checks and balances are in place.

Peak Re defines a risk appetite statement articulating the level and types of risk that the Company is willing to take to achieve our corporate goals and business strategies. This statement is crucial for guiding our pursuit of business opportunities within acceptable risk boundaries. Calibration of the risk appetite statement is a dynamic process requiring regular updates to stay aligned with business growth, changes in risk profiles, and strategic planning.

The ability to identify, assess, and manage risks reflects an organization’s ability to respond and adapt to changes. Risk assessment and management processes enable Peak Re to quickly recognize potential adverse events, be more proactive, and establish appropriate risk responses. However, the focus of risk management is not to accurately predict the future. Risk management makes Peak Re more resilient by identifying potential fragilities and implementing management actions.

Operational risk describes the potential for loss due to failures in internal processes, systems, or from external events. This broad category includes a variety of incidents, such as unintentional execution errors, system breakdowns, acts of nature, conscious policy breaches, and instances of excessive risk taking.

Governing operational risk is a dynamic process that is routinely reviewed by risk owners and the risk management team. It is also under the vigilant oversight of the Executive Committee and Risk Management and Compliance Committee (RMCC). The RMCC is continually informed by reports from the Chief Risk Officer and the Internal Audit function, with additional reviews of operational risk conducted by the Executive Committee during its monitoring of the Company’s progress against defined business plans.

Peak Re writes a diversified business portfolio across various lines of business. To manage insurance risk, we maintain disciplined and selective underwriting, limit our exposure to losses within risk limits, and continue to diversify across regions, products, and risk coverages.

We seek to balance our cash flow and liquidity needs with the need to deliver a positive income while maintaining our high-quality, diversified portfolio. As we face exposure to shifts in market prices, interest and currency exchange rates, and more, we employ an approach to ensure we can weather these market influences.

Our focus on integrity and fairness encompasses how we work with clients, business partners, and one another. We foster a collaborative and inclusive environment for growth, both for our business and our employees. We take pride in the trust placed in us and maintain a strong culture of compliance, transparency, financial strength, and risk management.

Our Code of Conduct outlines Peak Re’s core principles and values which enable us to deliver our strategy. It sets out behaviors expected from all employees and guides us in everything we do. All employees are responsible for acting in the spirit of the Code and follow our ethical values of acting with honesty, integrity, diligence, fairness, responsible citizenship and accountability in conducting business. Mandatory training covering key topics under the Code of Conduct is provided to all of our employees globally, as well as trainings on Anti-Money Laundering and Counter-Terrorist Financing, Sanctions, Anti-Bribery and Corruption, Data Privacy, Information Security, and Diversity, Equity, and Inclusion.

Peak Re respects and protects personal data in accordance with applicable local data protection laws and regulations as well as legal obligations. Our Group Data Protection Policy and Privacy Principles outline our commitment to safeguarding personal data and express our commitment to business partners, employees and all stakeholders with whom we have business interactions.

Peak Re employees are all responsible for safeguarding the confidentiality and security of personal data. We implement appropriate technical and organizational measures to process personal data in compliance with applicable laws, with the objective to prevent unauthorized or accidental loss, disclosure, access, use, destruction or change of personal data. Our data protection program is reviewed regularly as we continue to strengthen our data protection control framework.

Peak Re is committed to protecting our products and services from being used for money laundering, terrorist financing, proliferation financing, bribery and corruption, sanctions and trade controls violations or other criminal activities. Our financial crime risk management framework is supported by relevant policies aligned with applicable laws and regulations in all jurisdictions where we operate.

Peak Re’s Group Anti-Money Laundering and Counter-Terrorist Financing Policy sets out requirements on the company’s risk-based approach to counterparty due diligence procedures, ongoing monitoring, suspicious transactions reporting and record keeping. We adhere to all applicable international trade and economic sanctions including UN, U.S., E.U., U.K., Hong Kong and all other applicable statutory regimes. Sanctions may prohibit or restrict Peak Re from doing business with certain individuals, entities, groups and/or countries. They may also restrict our investment in a targeted country or entities, as well as trading in certain goods, technology and services, including financial services. As the sanctions landscape is continuously evolving, we actively monitor and keep abreast of regulatory developments to respond to and manage impacts to the company, adopting enhanced controls for areas with heightened sanctions risk.

We adhere to all applicable international trade and economic sanctions including UN, U.S., E.U., U.K., Hong Kong and all other applicable statutory regimes. Sanctions may prohibit or restrict Peak Re from doing business with certain individuals, entities, groups and/or countries. They may also restrict our investment in a targeted country or entities, as well as trading in certain goods, technology and services, including financial services. As the sanctions landscape is continuously evolving, we actively monitor and keep abreast of regulatory developments to respond to and manage impacts to the company, adopting enhanced controls for areas with heightened sanctions risk.

with Peak Re