Following two earlier articles on climate change’s impact on the property protection gap and the broader ecosystem[1], this article concludes our mini-series by focusing on the role of insurance in building climate resilience. As the world edges ever closer to exceeding 1.5°C above pre-industrial levels, efforts towards decarbonisation must be complemented by climate adaptation and mitigation plans. Integrating adaptation and mitigation into the overall climate strategy is fundamental to creating a comprehensive approach that not only addresses immediate physical risks but also contributes to managing longer-term spillovers. This article will explore how insurance can play a pivotal role in enhancing climate resilience by making adaptation and mitigation projects more investable and ensuring that climate risks remain insurable in the future.

Closing the resilience deficits: the financing gap

Alongside continuous efforts towards decarbonisation, climate adaptation and mitigation plans are instrumental in building and strengthening societal resilience to climate change. In particular, embedding resilience into infrastructure will help to prevent, reduce and delay climate change’s impacts on health, societies and economies. Furthermore, robust infrastructure supports a swift recovery from external shocks and quickly stabilises the affected population.

While the scope of adaptation and mitigation plans encompasses a wide range of actions and initiatives, this article will focus on financing resilience infrastructure projects. Importantly, climate resilience projects are attractive on financial terms. A report from the World Bank examining four essential infrastructure systems in developing countries (i.e., power, water and sanitation, transport, and telecommunications) found that building resilience into these systems would require an extra 3% of the overall investment needs. Yet, greater resilience would lead to fewer disruptions and reduced economic impacts, thus generating an estimated overall net benefit of USD 4.2 trillion over the lifetime of new resilient infrastructure.[2] This represents a USD 4 in benefits for each USD 1 invested.

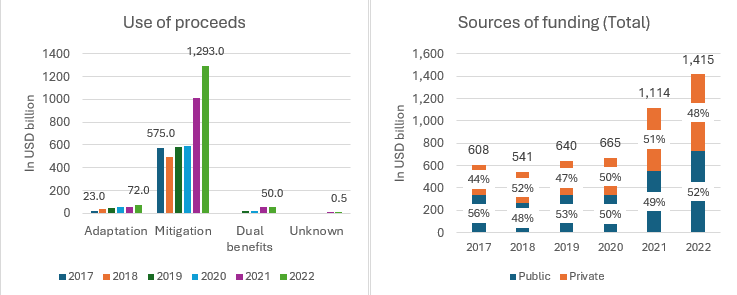

The challenge is securing the necessary funding for climate adaptation and mitigation projects. The Climate Policy Initiative estimates that the annual global climate financing needs will reach USD 9.0 trillion by 2030, up from an estimated spending of USD1.4 trillion in 2022.[3] While sizeable investment flowed into mitigation and adaptation plans from both the public and private sectors in 2021 and 2022 (see Exhibit 1), much more will be needed in the immediate years, as echoed in repeated calls, for instance, at the COP29, to scale up funding, particularly for emerging markets.[4] This will be harder to achieve given that, over the past years, housing development and essential infrastructure have faced increasing funding challenges due to high inflation and interest rates. A mediocre economic outlook and weak construction markets are having their impacts felt, causing delays and cancellations even of mega-mitigation projects.[5] Arcadis, for example, expects investment to be harder to secure in a capacity-constraint market in the near term.

Exhibit 1: Use of proceeds and sources of the global climate finance

Source: Climate Policy Initiative, Global Landscape of Climate Finance 2023, 2023

Note: public funds refer to investment from development banks, governments, export credit agencies, public funds, multilateral climate funds, state-owned enterprises and financial institutions. Private funds mean from commercial financial institutions, private corporations and funds, individual and institutional investors.

Closing the financing gap by making climate-related projects bankable

Against the backdrop of tight financing and a widening resilience gap, it is paramount that we consider how insurance and risk transfer can increase the bankability of climate-resilience infrastructure projects.

A simplified view: Potential financiers of climate-resilience projects (i.e., banks and other institutional investors, and public-sector actors) are primarily concerned about credit risk exposure and the potential adverse impact on their liquidity, capital positions, and operations.[6] Credit risks arise from non-performing loans or financial instruments due to the eroded balance sheet strength of the contractor or issuer.[7] Thus, in evaluating the creditworthiness of a resilience-related financial instrument with collateralised assets, rating agencies would consider, among other things, the scope and extent of protection afforded by insurance covers. This could refer to compensation for physical losses after a climate event or protection to mitigate supply-chain disruption or loss of revenues. If the insurance proceeds are sufficient to offset the financial loss and to fund repair costs and loan repayment, negative rating action might be avoided. Insurance is thus viewed as an offset to financial risks from climate-related events, protecting the creditworthiness of the issuers and their issued financial instruments.

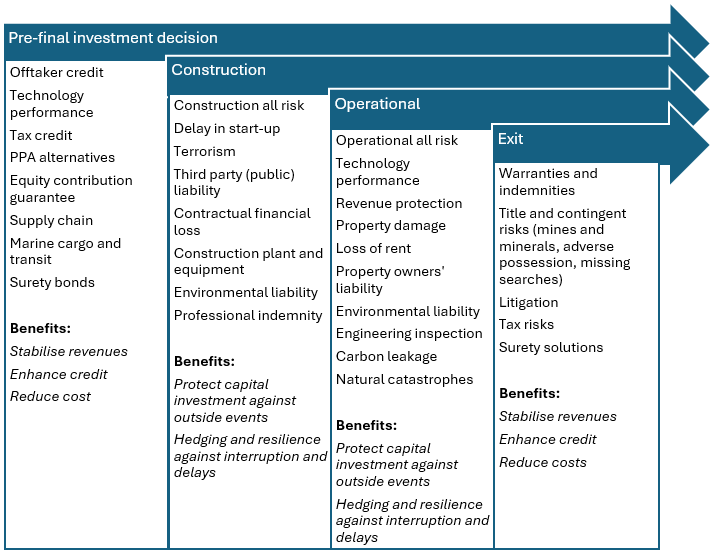

Insurance and risk transfer can enhance the attractiveness of resilience-building infrastructure projects in multiple ways. Through insurance, project owners and contractors can enhance and stabilise the projects’ return, increase their viability, and protect the capital invested. This will further reinforce the projects’ business cases and provide the long-term security required by banks and other investors. Exhibit 2 lists examples of insurance protection for consideration at each stage of the construction phase, and some use cases.

However, project owners, contractors, banks and other investors generally fail to engage insurers until late in the project development process. This may be due to a lack of communication, leading to an unawareness of the critical role insurers can play in unlocking project financing.[8] As a result of this late involvement, insurers have only a limited ability to customise insurance solutions to increase the bankability of projects.

Exhibit 2: Examples of insurance solutions by project phase and benefits.

Source: Howden, Boston Consulting Group and the High-Level Climate Champions, The great enabler: A collection of insurance solutions powering $10 trillion of climate finance, 2024

Resilient ecosystem and cross-sector cooperation to improve insurability of climate-related risks

Insurance premiums for physical risks and natural disasters are expected to increase by 50% by 2030, reaching USD 200-250 billion globally. This significant growth will be driven by elevated losses and exposures to climate events, as well as governments transferring public liabilities to private markets. Predicting whether the insurance industry can meet the demand at the necessary speed, scale, and scope is challenging. However, without insurance, businesses, societies and governments will struggle to cope with the increasing burden of climate change.[9]

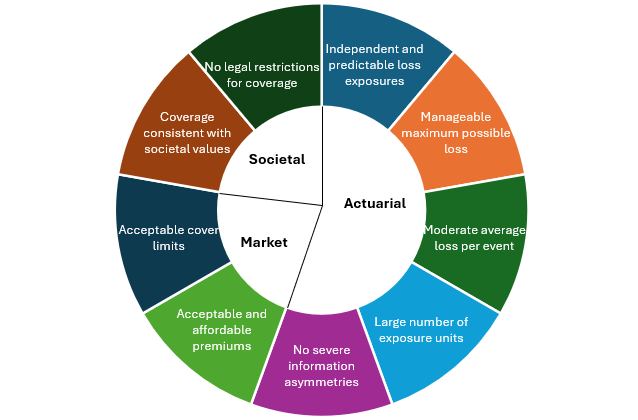

Several challenges need to be addressed to ensure climate change-related risks remain insurable over the longer term and to reap the full benefit of risk transfer solutions. As illustrated in Exhibit 3, climate change is challenging some of the core principles of insurability. For instance, mega losses are increasing, and covers are becoming more expensive. The pattern of emerging extreme weather events, like floods, also challenges the insurability principle that the risk needs to be independent and predictable.

Furthermore, there are other mundane issues related to engagement, the cyclicality of insurance capacity, the generally short-term nature of (P&C) insurance products, data and model availability, and weak regulatory environments in some markets.[10] Engagement issues arise from the generally late involvement of insurance in resilience infrastructure projects. A weak regulatory environment might favour fraudulent claims. In addition, the current approach to modelling climate risks and validating results is often based on historical experience, which may no longer be sufficient to reflect the changing risk landscape. This could jeopardise the sustainability of the insurance business model and increase the gap between the demand for insurance protection and available insurance capacity.[11] The worst-case scenario is insurers walking away from high risks, further widening the protection gap.

Consequently, governments, businesses, and insurers need to work on cross-sector planning to mitigate climate-related risks and ensure their sustainable insurability. Governments and businesses should invest in resilience measures, while insurers and reinsurers should work to improve their analytical capabilities and data collection for more accurate pricing. That way, insurers can develop and offer appropriate and affordable insurance coverage, strengthening society’s and businesses’ viability and resilience to climate change.

Exhibit 3: Fundamental criteria of insurability.

Source: The Geneva Association, The value of insurance in a changing risk landscape, 2024

Building a climate-resilient society and ecosystem is beneficial to all stakeholders. Currently, the investment in adaptation and mitigation plans is deemed insufficient. Risk management is perceived as a crucial solution to unlock more funds for these projects by transferring risks that banks and investors are unwilling to take to insurers. In addition to investing in more resilient infrastructures, governments and businesses need to understand that insurers are an integral part of the ecosystem in the resilience journey. Therefore, a joint effort between different parties is the key to ensuring insurance capacity and affordable protection are available, enabling insurers to support society in bouncing back more quickly after a natural disaster.

[1] See Climate change and emerging markets: The property protection gap challenge, and Climate change and the ecosystem: A rising insecurity issue, 2024 Peak Re.

[2] Hallegatte, Stephane; Rentschler, Jun; Rozenberg, Julie., Lifelines: The Resilient Infrastructure Opportunity., Sustainable Infrastructure Series, 2019, Washington, DC: World Bank

[3] Climate Policy Initiative, Global Landscape of Climate Finance 2023, 2023

[4] United Nations Climate Change, COP29 UN Climate Conference Agrees to Triple Finance to Developing Countries, Protecting Lives and Livelihoods, 2024

[5] Arcadis, International Construction Costs 2024: Race for Capacity, 2024

[6] Aon plc, Why is Climate Change Important for Financial Institutions?, 2024

[7] S&P Global Ratings, Insurers' Response To Catastrophic Events Could Affect Issuer And Instrument Creditworthiness, 2024

[8] Howden, Boston Consulting Group and the High-Level Climate Champions, The great enabler: A collection of insurance solutions powering $10 trillion of climate finance, 2024

[9] Howden and Boston Consulting Group, The bigger picture, 2024

[10] Howden, Boston Consulting Group and the High-Level Climate Champions, The great enabler: A collection of insurance solutions powering $10 trillion of climate finance, 2024

[11] Marsh McLennan, Building a climate resilient future, 2023

with Peak Re