- The 2025 global economic outlook faces significant external headwinds but will continue to be anchored by a resilient US economy and stabilising growth in China.

- Despite considerable policy uncertainties of the second Trump presidency, we expect US economic growth to continue. However, inflation could stay sticky due to the potentially inflationary policies from the new US administration.

- The Chinese economy shows signs of stabilisation towards the end of 2024. The pursuit of more accommodative monetary policies and the prospect of fiscal supports are expected to sustain more solid growth this year.

- The macroeconomic backdrop should continue to benefit insurance demand through income and GDP growth, though the normalisation of inflation and interest rates may take longer than previously anticipated. Financial market volatility will continue to feature prominently in a year of unremitting global geopolitical uncertainty.

Introduction

The influence of geopolitical risks on the 2025 global economic outlook cannot be overstated. From the inauguration of a second Trump presidency in the US to ongoing violence in Ukraine and the Middle East, geopolitical events both near and far from Asia will continue to make their impact felt.

However, domestic policies also play a crucial role in defining Asia’s economic outlook in 2025. The anticipated shift towards more accommodative monetary policies in China, alongside sustained fiscal stimulus, is expected to underpin stable GDP growth in the world’s second-largest economy. In India, infrastructure investment and production-linked incentive schemes will continue to support growth, while the central bank is expected to maintain its stance after nine consecutive pauses, as inflation remains uncomfortably high. Meanwhile, the Bank of Japan will grapple with further normalisation of interest rates, as inflation appears comfortably anchored at a level higher than the 2-percent target.

The confluence of external and domestic factors suggests that overall growth in Asia will remain robust and stable, though the level of uncertainty is likely to increase as we move into the latter part of 2025.

Global and US economic growth outlook

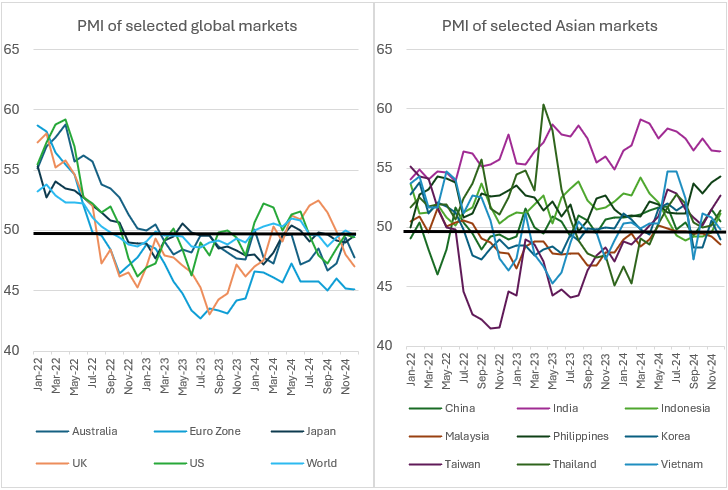

According to the IMF, the world economy is estimated to have expanded robustly by 3.2% in 2024, unchanged from 2023. Asia remained the key growth powerhouse, while the Euro area was mired in a growth soft patch, recording growth of 0.8%. This pattern is reflected in the distribution of PMI indexes between advanced and Emerging Asia markets (see Exhibit 1). Going into 2025-26, we expect growth in emerging Asia will remain robust alongside a modest recovery in the Euro area.

Exhibit 1: Purchasing Managers’ Index (PMI) of selected global and emerging Asia markets

Source: LSEG Datastream

The US economy is expected to grow at a slower but still healthy 2% in 2025, after having expanded by 2.8% in 2024. This partly reflects the lagging impact of higher interest rates implemented from 2022 to 2024. Despite the beginning of a loosening cycle, Fed rates remained high at 4.64% in November 2024, a level not seen since before the global financial crisis in 2008. Market sentiments are increasingly focused on the inflationary impact from the new administration’s policies, which could result in interest rates remaining elevated for a longer period of time.

Meanwhile, various recession indicators are flagging warnings for the US economy, including an inverted yield curve. The gap between yields of 10-Year and 2-Year UST has turned positive since late August 2024. However, the last four designated US recessions all occurred shortly after the yield-curve inversion ended. Additionally, the triggering of the Sahm rule, which relies on monthly unemployment data and is triggered when the three-month moving average unemployment rate increases by 0.5% or more relative to its low in the previous 12 months, has predicted all recessions in the past half-century in the US. On the other hand, there are sufficient idiosyncratic factors to believe the recent increase in unemployment is not a prelude to recession. For example, the rise in the unemployment rate is partly due to an increase in the labour force, rather than simply job losses.

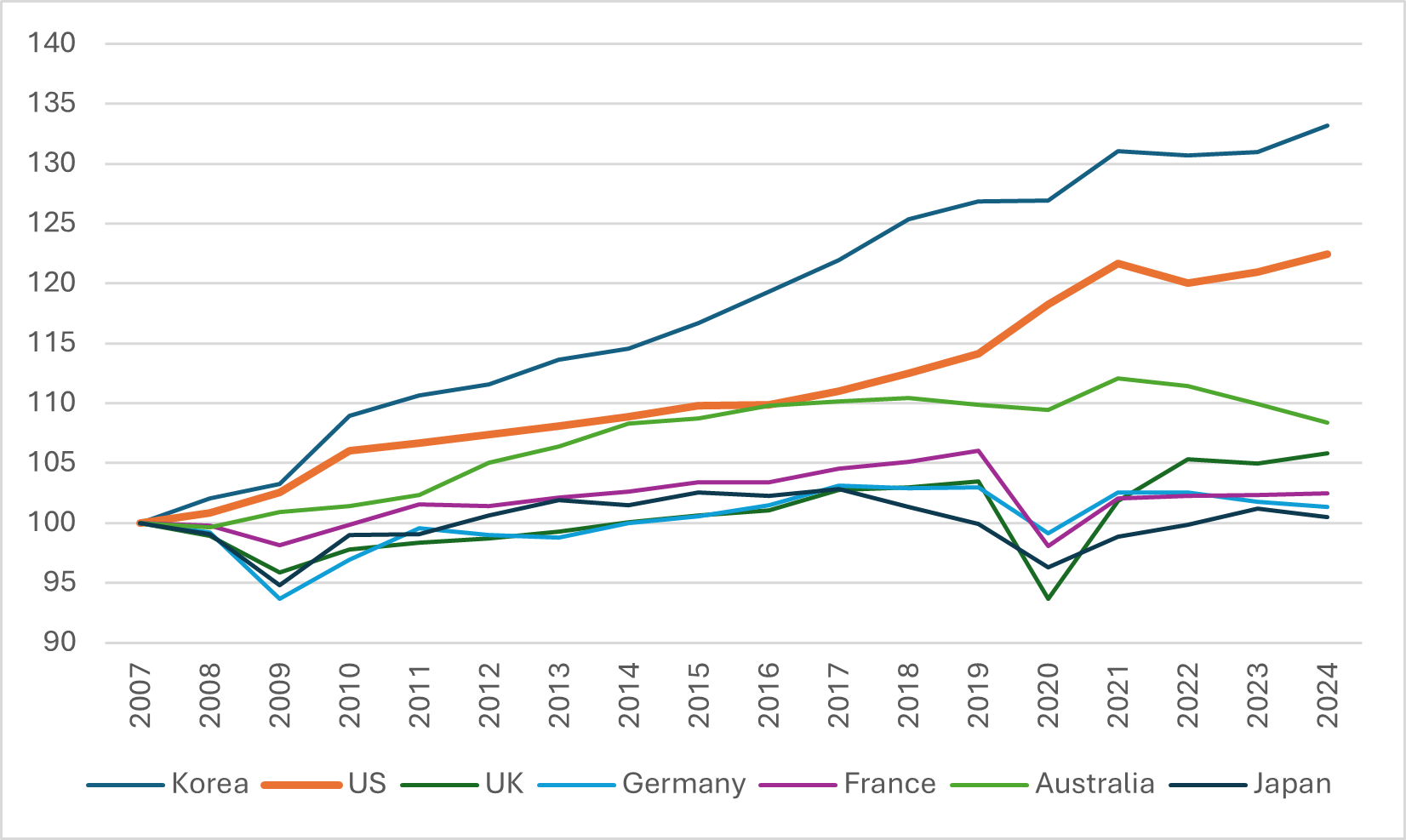

Overall, despite these warning flagged by these indicators, we maintain that the US should be able to secure a soft landing. The recent trend of disinflation could continue, assuming there are no major inflation-boosting policies soon. Furthermore, US economic fundamentals are underpinned by strong labour productivity gains (see Exhibit 2).

Exhibit 2: US Labour Productivity Gains (Index, 1 Jan 2007=100)

Source: LSEG Datastream / Fathom Consulting

Trade and financial market volatility

The beginning of the second Trump administration could bring major changes in US economic policies, raising global financial volatility. He has hinted at a 20% tariff on exports from Canada and Mexico, and a 10% tariff on those from China. However, it remains to be seen whether this will materialise, as tariffs (and other trade barriers) are often used as negotiation chips for non-trade-related issues like drugs and immigration.

It is nonetheless reasonable to assume that under the second Trump administration, he will pursue tax cuts, impose higher tariffs on major trade partners, enforce some forms of immigration control (i.e., “de-immigration”) that would tighten the US labour market, support fossil fuel extraction, and roll back some provisions of the Inflation Reduction Act (IRA) of 2022. The overall impact on US economic growth and inflation is difficult to ascertain at this stage, as some policies could offset each other. For instance, lower taxes could stimulate growth and increase federal deficits, but these effects might be counterbalanced by higher tariffs. Much will depend on the extent, timing, and sequencing of these policy proposals, as well as the reactions from other countries

Nevertheless, given the rhetoric of the incoming Trump administration and the experience from his first tenure as US President, we believe the impact on the US and global economies could be relatively muted in the near term. The first half of 2025 is likely to see continuous stable economic growth, while momentum could slow sequentially in the second half.

Asia and China economic outlook

The economic outlook for Asia will continue to hinge on the performance of China, which is currently facing a host of challenges, including a prolonged adjustment in its real estate sector, weak consumer sentiment, disinflation, high local government debts, and the threat of additional trade barriers from the US. For instance, the latest inflation figures hint at sustained deflationary pressures. Headline CPI rose 0.1% year-on-year in December 2025, from 0.2% in a month earlier. Continuing a two-year trend of falling producer prices, the PPI was down 2.5% year-on-year in November, though this was less severe than the 2.9% drop in October. The timid inflation figures, coupled with modest retail sales growth (+4.8% year-on-year in October, partly bolstered by a series of supportive policies announced in September, including a CNY10 trillion debt swap plan following a monetary policy package earlier in September), point to still weak consumer demand and confidence.

While there are lingering concerns that China could be caught in a deflationary spiral—lowering inflation and GDP growth—we remain cautiously optimistic that a combination of more proactive fiscal policy and a moderately loose monetary stance will help jump-start the economy in 2025. Furthermore, GDP growth in the range of 4-5% can hardly compare with earlier examples of deflationary growth.

China’s politburo reportedly asserted in early December that monetary policy will shift to "moderately loose" from "prudent" for the first time in 14 years. It further indicated the need to "strengthen extraordinary countercyclical adjustments," bolster consumption, and improve investment efficiency. This should lay the groundwork for the implementation of growth-supportive measures in 2025.

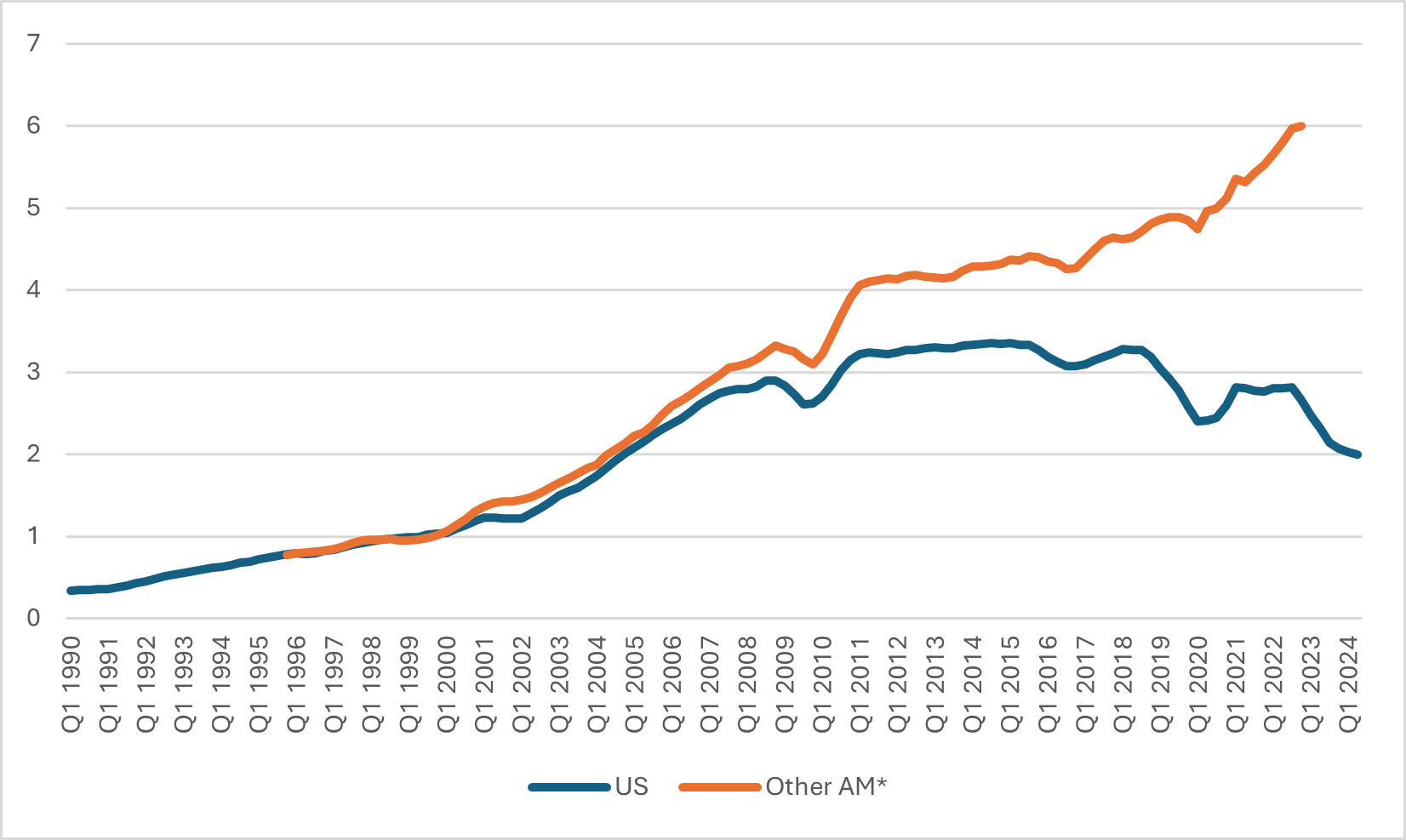

It remains to be seen whether and how there will be another round of the US-China trade war. Over the past decade, particularly since the first trade war, there has been a levelling off of China’s exports to the US but continuous increases to other major advanced markets (see Exhibit 3). In a sense, China has been successful in diversifying its exports to non-US advanced markets and other emerging markets. However, if significant tariffs are levied on Chinese exports across the board, it might become increasingly difficult for other markets to absorb the excess. Furthermore, there remains the risk of the US targeting Chinese production in overseas markets, which has thus far been exempt from US tariffs.

Exhibit 3: Gross Trade with China (% of Domestic GDP, 4 quarters moving average)

Source: LSEG Datastream / Fathom Consulting

Note: Other AM = Other Advanced Markets include EU, Canada, Australia, New Zealand, UK and Japan.

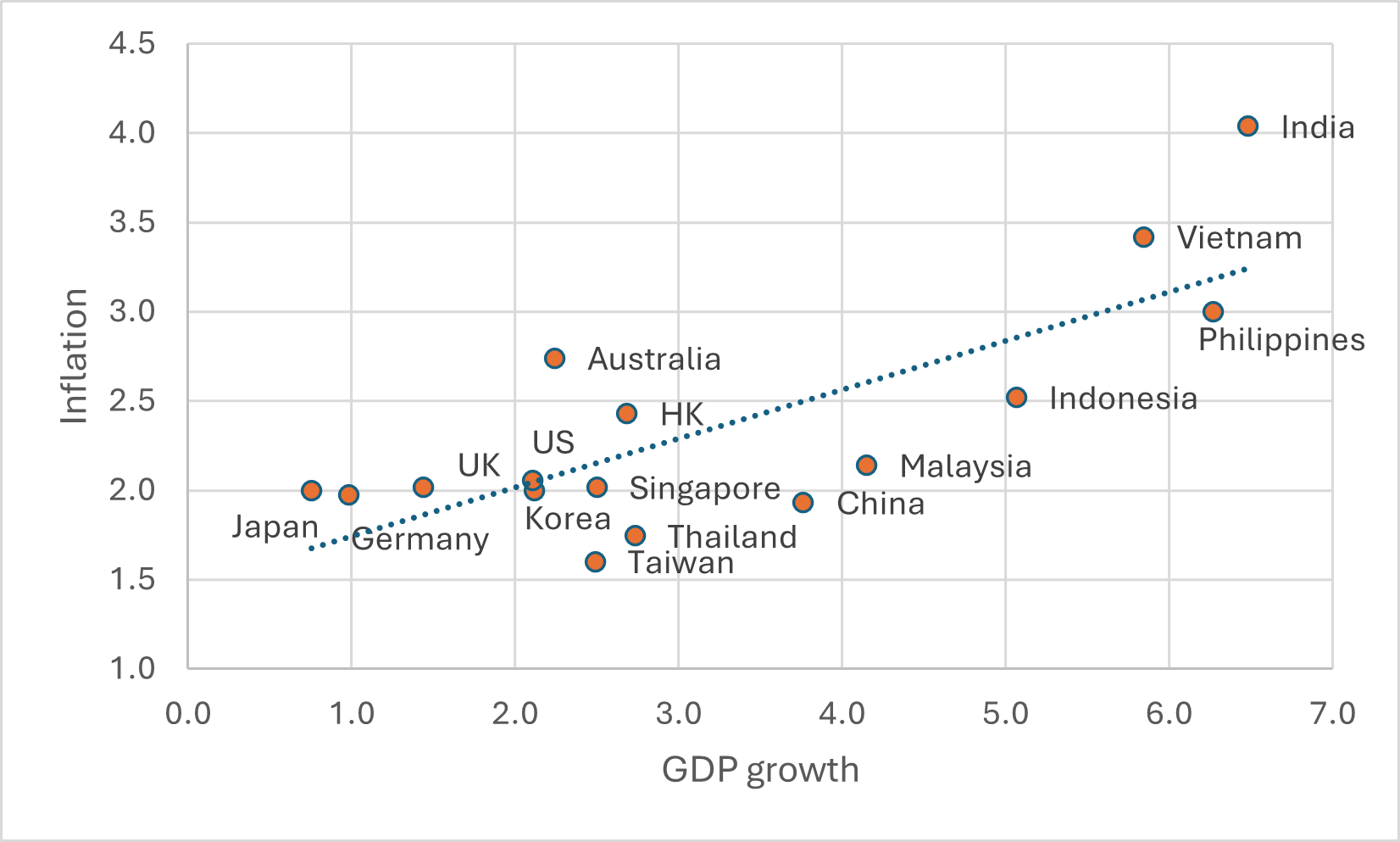

Despite significant geopolitical and macroeconomic uncertainties in 2025, we believe other major emerging Asian markets will continue to outperform. They have shown increasing resilience against external shocks in recent years, and domestic policies are supportive, focusing on improving efficiency and building up necessary infrastructure. Some markets, including India, Vietnam, and the Philippines, are expected to sustain strong growth in the near to medium term (see Exhibit 4). However, this will also be accompanied by rising price pressures, necessitating vigilant central bank actions to keep price increases under control. Most markets (particularly advanced markets) will be able to anchor inflation at around 2%. Emerging markets will face a more stringent trade-off between growth and price stability once their GDP growth exceeds 5%.

Exhibit 4: GDP Growth and Inflation of Selected Global and Asian Markets (2025-2029)

Source: IMF WEO Oct 2024

Note: CAGR 2025-2029; linear trend line added for reference (add trend line for 1990s, 2000s and 2010)

What this means for insurance

Economic growth

Global and Asian growth should remain intact, with the usual caveat that this is subject to the assumption that US policymaking will not result in too many disruptions and China’s reflationary policies come through swiftly. P&C insurance demand should continue to benefit from steady economic growth while risk awareness/aversion would underpin strong demand for climate- and catastrophe-related insurance. Over the past 10 years, P&C premium and real GDP growth have maintained a close correlation. For every 1% increase in real GDP growth, non-life premiums growth increases by approximately 0.62%. While recent growth in premiums has been mainly driven by rate increases rather than expanded coverage, protection gaps have likely widened further. We see the next phase of premium expansion from 2025 onwards could feature a rebound in covered exposures (but with negative implications on loss ratios).

Interest rates

The threat of tariffs (and softer US economic growth) could tempt the US Fed to chart a more cautious path towards monetary easing, notwithstanding Trump’s desire to see rates falling faster. In addition, while there has been a high degree of synchronisation among advanced market central banks, the monetary policies of emerging markets are more diverse. It can be construed that interest rates would remain higher in absolute terms for longer than previously expected. That will ease some of the pressure over insurance investment.

Inflation

Some of the policies in the pipeline could be inflationary, including the tax cuts and imposition of higher tariffs by the US. Overlaying the structural inflationary trends due to deglobalisation, demographics, and decarbonisation, it could result in inflation rebounding from its current close-to-two-percent level. That could negatively impact insurance through higher claims inflation, though the actual impact will be more nuanced due to the peculiarity of individual business lines.

Financial market volatility

The re-election of Donald Trump has introduced a significant level of uncertainty, particularly concerning potential changes in US economic policies. His administration's agenda, which includes tax cuts, higher tariffs on major trade partners, and deregulation, could provide short-term stimulation to the US economy but may also increase inflationary pressures. These policies could lead to friction with the US Fed, which has maintained a cautious stance on interest rates due to persistent inflation. Additionally, geopolitical tensions could further heighten market uncertainty and financial volatility, as these conflicts have the potential to disrupt global supply chains, especially in key sectors. The interaction between these geopolitical risks and domestic policy changes in the US will be a crucial factor in shaping market dynamics in 2025.

Conclusion

The global economic outlook for 2025 is characterised by a delicate balance between growth opportunities and significant risks. Technological advancements, public investment, and sustainability initiatives offer promising avenues for economic expansion. However, geopolitical tensions, high debt levels, inflationary pressures, and policy uncertainties present formidable challenges. Nonetheless, anecdotal evidence is still pointing to the continuous outperformance of Asia, and in particular emerging Asia, in this and the coming years.

with Peak Re