- Despite the headwinds from elevated interest rates and China’s growth slowdown, the global economy, led by emerging markets, is expected to maintain steady growth through 2024.

- We explore how emerging markets are becoming more resilient to global growth shocks, as they grow bigger and are more diversified. Rising incomes and a burgeoning middle class mean that consumption growth in emerging markets will continue to gain importance, reducing their reliance on advanced economies for export-driven growth.

- Ongoing structural reforms as well as a strengthening of monetary and fiscal policy frameworks have increased investor confidence in these markets, making them more resilient to market volatility.

Introduction

The global economy is projected to grow at a steady pace of 3.2% in 2024, continuing the healthy momentum from the previous year. In advanced markets, tight labour markets and increasing real wages have underpinned private consumption demand. Households drawing on their pandemic-era savings and higher government spending post-pandemic are also among the drivers for strong domestic demand. Meanwhile, with inflation inching lower towards central bank targets in advanced economies, interest rates are expected to start declining in the second half of the year, which could provide another boost to global economic growth.

Emerging markets have demonstrated remarkable resilience over the past couple of years despite a high interest rate environment, weaker global trade and a drag from China’s growth slowdown. Many large emerging markets have exceeded their trend growth, thanks to outperformance in private consumption, alongside increases in public and private capital spending.

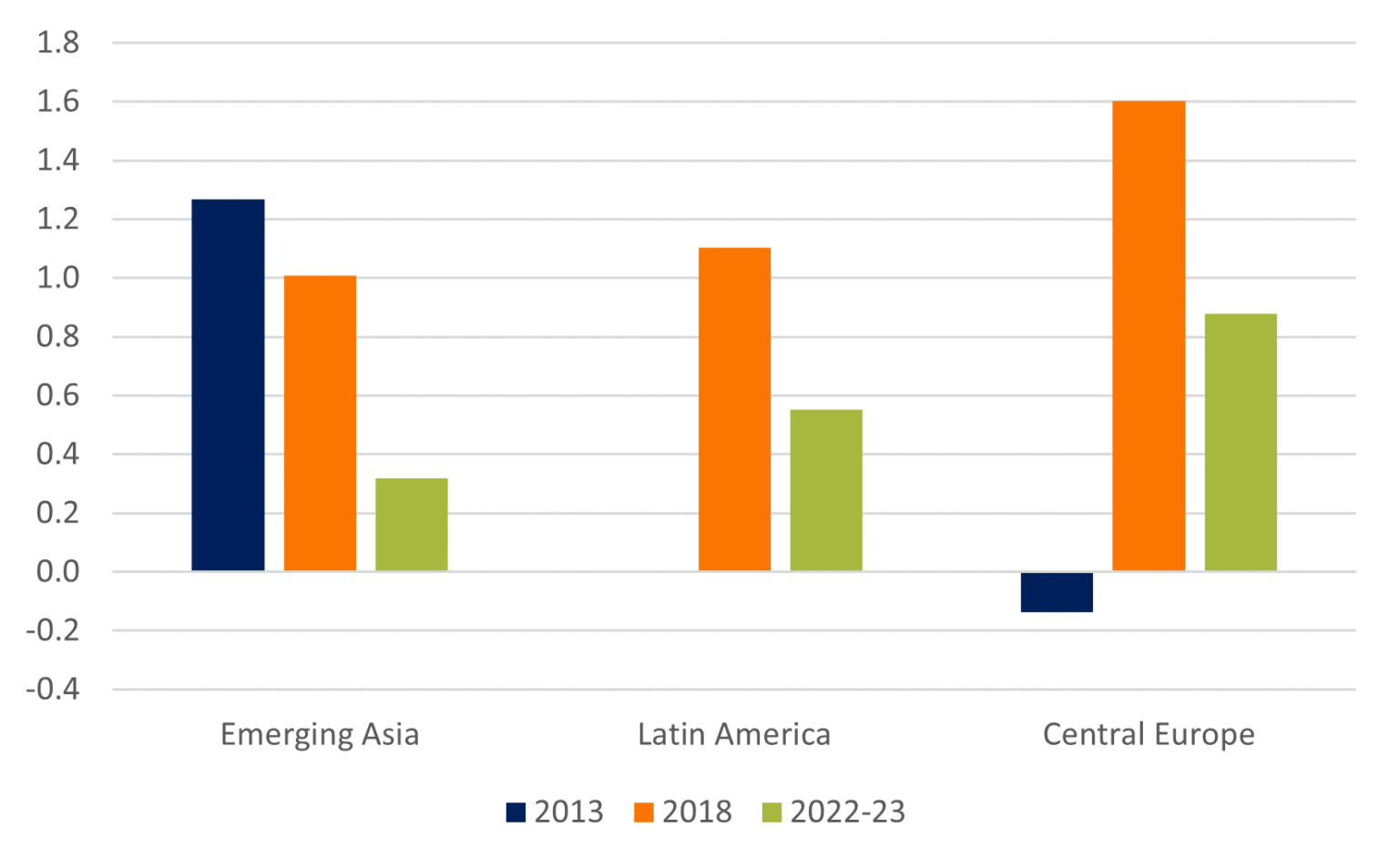

Compared to the previous episode of Fed rate hikes (or anticipation of hikes), such as the “taper tantrum” in 2013 and interest rate hikes in 2018, when emerging markets suffered significant capital outflows and several economies underwent a currency crisis, emerging markets have weathered the 2022-2023 high inflation and interest rates in relatively good shape. Emerging market rates have been less vulnerable to external shocks, particularly to interest rate changes in advanced markets in 2022-2023, as illustrated in Figure 1.

A recent IMF study[1] showed that large emerging markets increasingly resemble advanced economies in that they are no longer at the receiving end of global shocks, and their output fluctuations have become less volatile. We explore some of the drivers of this emerging market resilience.

Figure 1: Sensitivity of major emerging market interest rates to US interest rates in 2013, 2018 and 2022-23

Source: Bloomberg, Peak Re calculations

Notes: Sensitivity was calculated as the regression slope between emerging markets’ 5y government bond yield and the 5y US treasury yield.

Emerging Asia economies include China, India, Indonesia, Korea, Malaysia and Thailand.

Latin America includes Chile, Colombia, Peru, and Mexico. For Latin America, 2013 numbers were excluded due to poor data quality.

Central European emerging markets include the Czech Republic, Hungary, Israel, Poland and Romania. In 2013, Central European emerging markets saw a reduction in interest rates in line with the European Central Bank’s interest rate cuts.

“What is clear is that G20 EMs as a group—beyond China alone—have emerged as an important source of global and regional spillovers, which are only set to grow as these economies continue to integrate further into finance and trade.”

– World Economic Outlook April 2024, the IMF

Emerging markets are less reliant on advanced markets for growth

Over the last two decades, emerging markets have become a major growth powerhouse of the global economy, rising to account for a substantial 30% share of global GDP today. Besides being manufacturing hubs, emerging markets are also increasingly important as consumers and investors. Rising incomes, a burgeoning middle class and increasing urbanisation have bolstered the contribution to growth of domestic consumption in emerging markets.

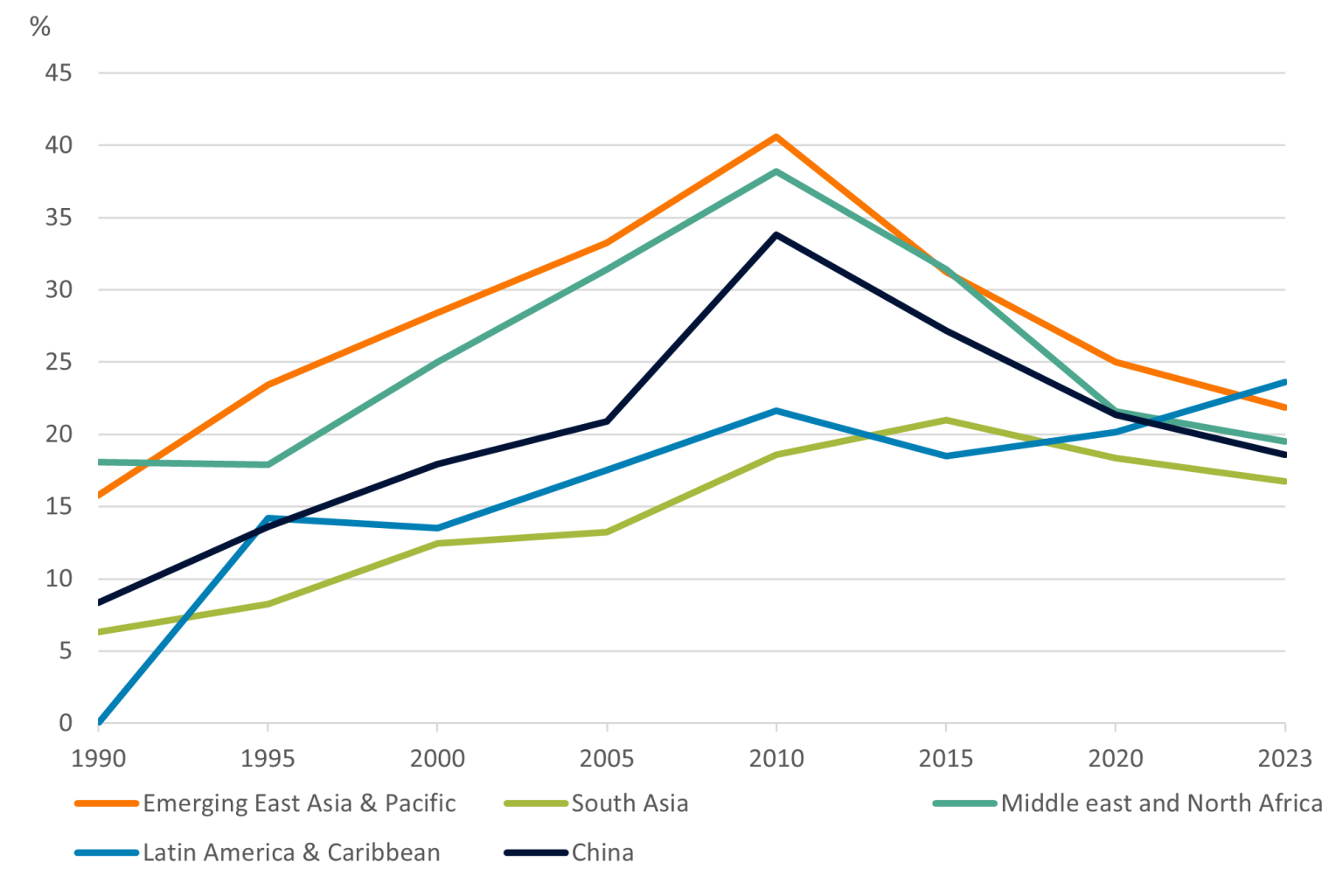

As the emerging market economies grow larger and more diversified, they have become less reliant on exports and commodities-based activities as primary growth drivers (see Figure 2). These shifts are evidenced in the rising contribution of sectors such as consumer discretionary and technology, while the significance of commodity sectors has declined. While they are not entirely immune to advanced markets shocks, economic diversification has contributed to emerging markets’ reduced vulnerability to external shocks emanating from advanced markets.

Figure 2: Exports contribution to GDP for many emerging markets peaked around 2010

Source: World Bank

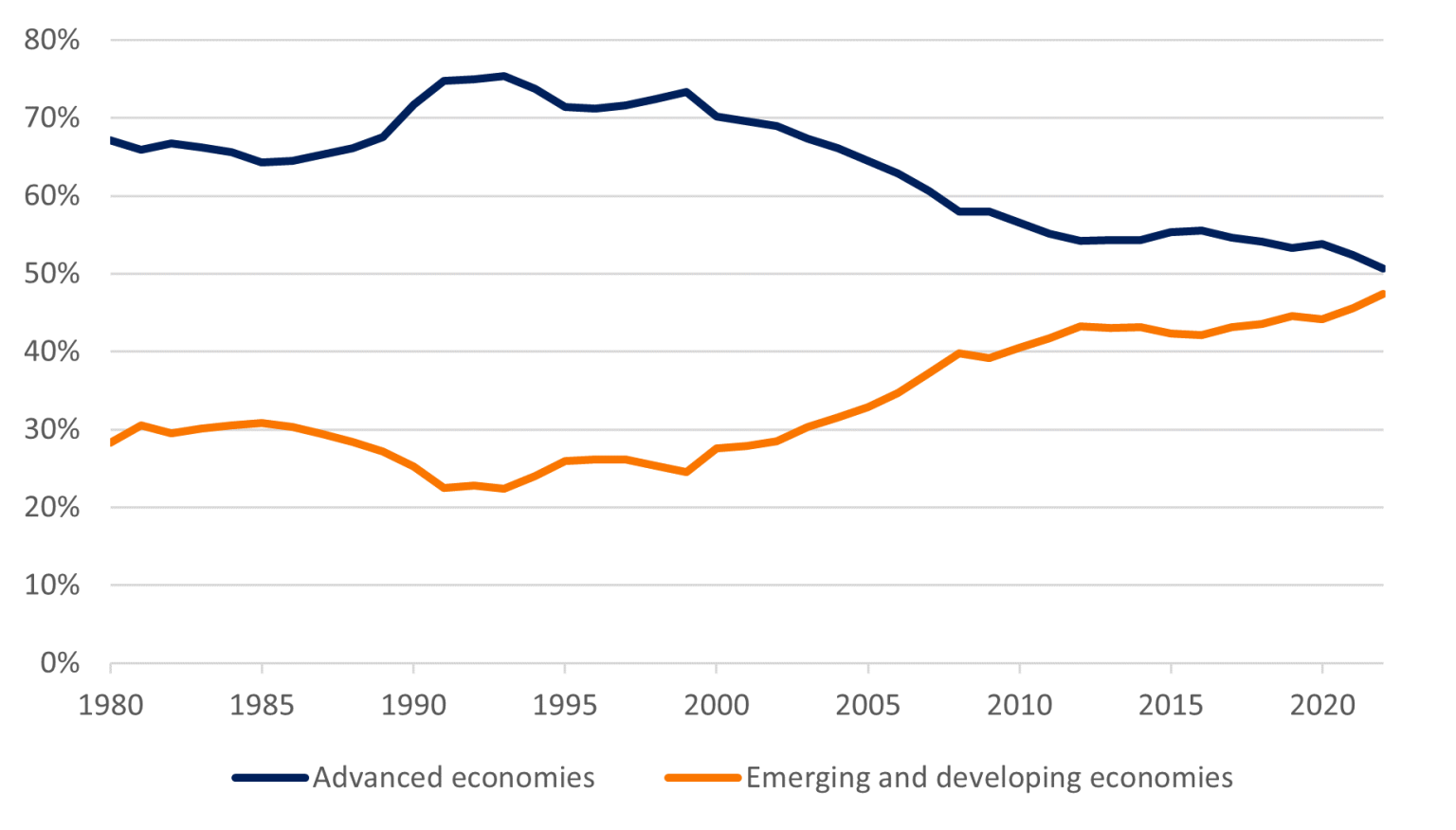

At the same time, intra-emerging-markets trade and investment flows have gained more importance (see Figure 3). The intra-emerging-markets trade is no longer primarily a reflection of global manufacturing supply chains, but also increasing final demand from emerging markets. Encouragingly, these shifts are underpinned by long-term trends including income growth and favourable demographics that are expected to remain intact in the near future.

Figure 3: Trade flows among emerging markets have become more significant (as % of emerging markets’ trade with the world)

Source: IMF Direction of Trade statistics, Peak Re calculations

Notes: Trade flows are calculated by aggregating exports and import flows from and to emerging market economies. Sum does not equal 100 since not all world economies are included, only advanced and emerging market economies.

The IMF projects emerging markets to continue growing by an average of 4.2% over the next 3 years compared to 1.75% for advanced economies. Within emerging markets, emerging Asia is expected to continue outperforming other regions.

Notably, in South and Southeast Asia, particularly in India, Indonesia and the Philippines, consumption demand has been robust, alongside growth supported by increasing public infrastructure investment and private investments in manufacturing and technology sectors.

In the Middle East, Saudi Arabia and Qatar are expected to beat their trend growth, benefiting from an infrastructure boost and a proactive economic diversification strategy into services and away from commodity-based activities. In Latin America, Brazil’s growth is driven by consumer spending, which benefits from social transfers and a robust labour market. In Mexico, growth has been bolstered by public infrastructure spending, and increasing trade and investment against a backdrop of global restructuring of manufacturing supply chains.

Structural reforms and restructuring of supply chains

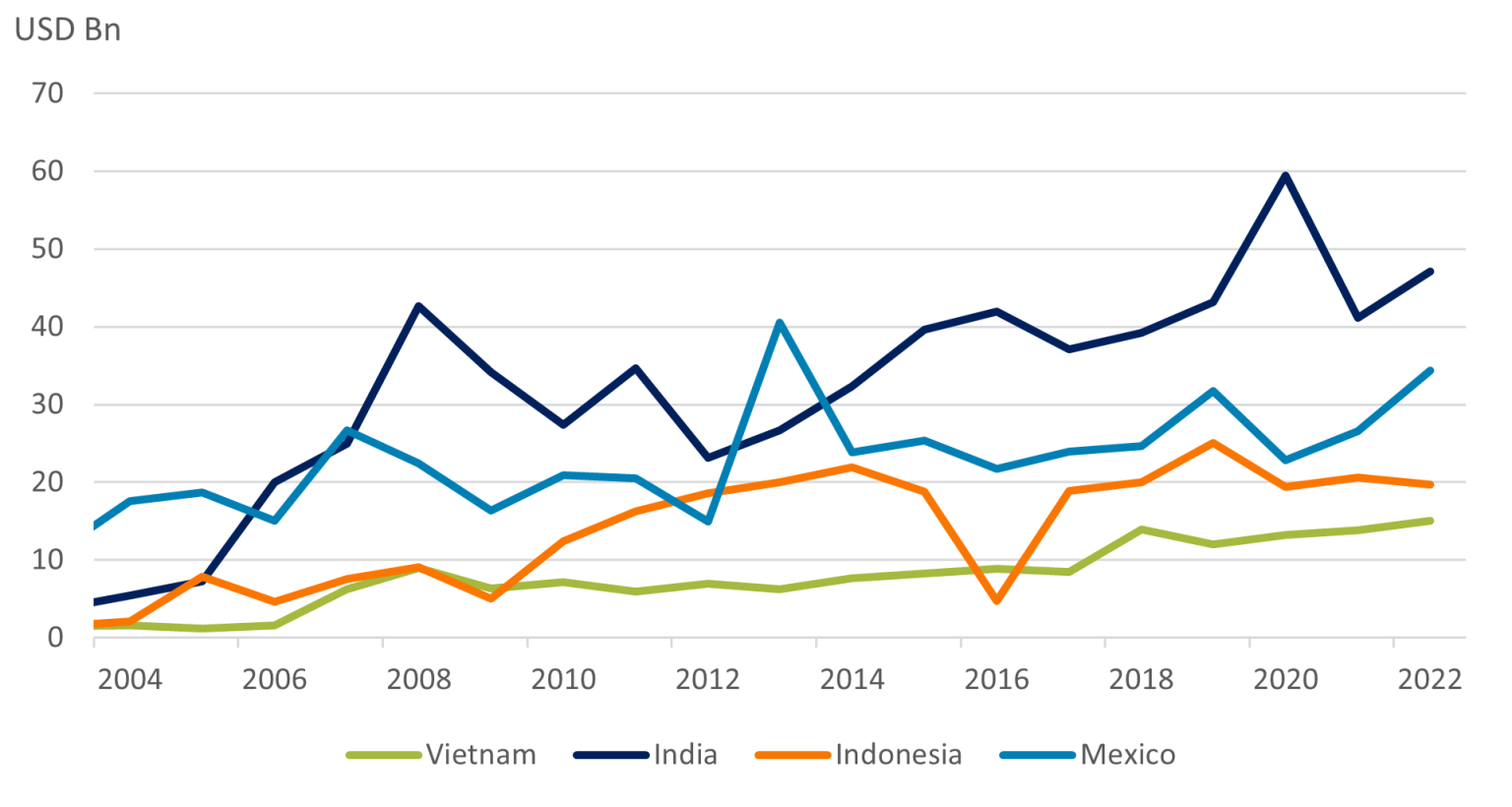

Many emerging economies outside of China have benefitted from the recent global trend of supply chain relocation. At the same time, early efforts to implement structural reforms and a renewed focus on supportive government policies and infrastructure investment also helped to improve their growth outlook.

Of note, rising geopolitical tension since 2018, coupled with the supply chain disruption from the pandemic, has ushered in a sustained global supply chain restructuring across sectors, with a particularly strong focus on the technology sector. Manufacturers have acted to shorten their supply chain, build redundancy, and increase friend-shoring or home-shoring of some of the production processes.

Mexico and Vietnam are among the largest beneficiaries of the restructuring and rerouting of global supply chains. Malaysia and India have also benefitted from greenfield manufacturing investment, particularly in the tech sector. For example, Apple’s suppliers in India have quadrupled from 4 in 2017 to 14 in 2022 [2] , increasing India’s share of iPhone production to 14% of the total. Meanwhile, Taiwanese electronics producers in the Apple supply chain have also been building more downstream production facilities in India and across ASEAN.

This has resulted in increasing foreign direct investment inflows into some major emerging markets. (see Figure 4). These strategic investments are welcomed by economies due to their role in supporting long-term growth, domestic job creation, and regional development. Moreover, due to their strategic and long-term nature, such direct investments tend to be less volatile and are not quickly liquidated in times of cyclical market stress.

Figure 4: Foreign Direct Investment Inflows (net of outward direct investment) for select countries

Source: World Bank

Furthermore, there has been an increased emphasis on structural reforms in major emerging markets, alongside an increased focus on infrastructure construction and the use of private capital and public-private partnership (PPP, such as in the Philippines, India, Saudi Arabia and Qatar). In particular, many markets have revamped regulations aiming at improving the ease of doing business, and putting in place measures to attract foreign investments against the backdrop of fast expanding local technology sector (for example, in India, the Philippines and Indonesia). These, coupled with earlier implementation of macro-prudential measures, have helped strengthen the attractiveness of emerging markets and their resilience against external shocks.

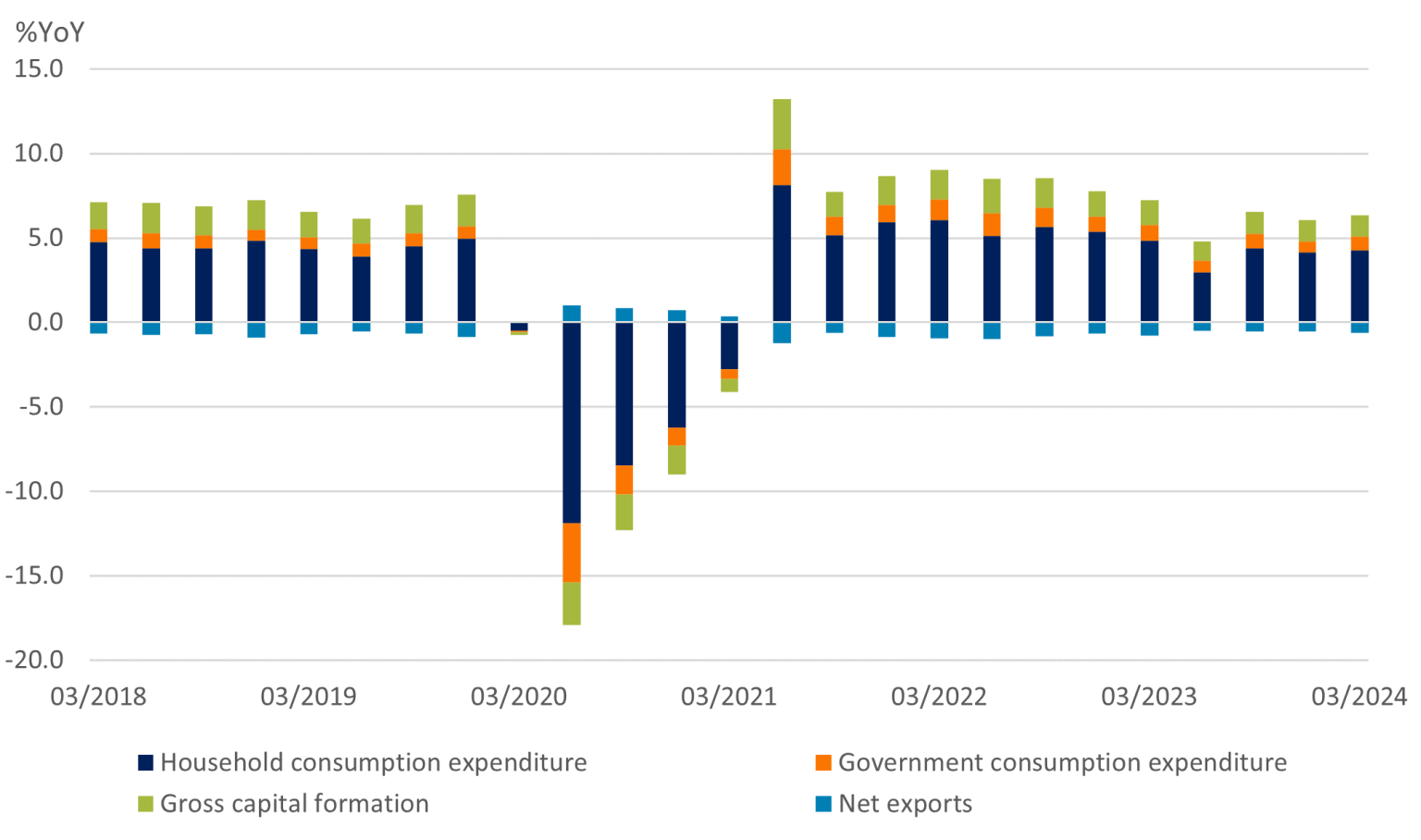

BOX: The Philippines: Strong growth outlook, amid structural reforms and policy stability measures

In 2023, the Philippine’s economy grew 5.6%, making it the fastest-growing economy in the ASEAN region. Barring the pandemic years of 2020-2021, household consumption has consistently grown at a steady pace of 6% on average and contributes the largest proportion – around 75% – to the Philippines’ GDP (See Figure 5). For 2024 and 2025, the country is expected to grow at a steady pace of over 6% per annum. The strong growth record and projected trajectory demonstrate the Philippines’ resilience to cyclical volatility both on the trade and financial fronts.

Figure 5: Philippines: Contribution to GDP growth

Source: Philippine Statistics Authority, CEIC, Peak Re calculations

The Philippines’ consumption growth has been supported by solid employment and income growth. The growth in the digital economy, in particular, has improved employment domestically, both in the tech and the informal or gig sectors, despite a reduction in overseas employment seen during the pandemic years. In December 2023, the national unemployment rate dropped to 3.1%, the lowest in history. With its steady growth, the World Bank expects the Philippines to cross the threshold of USD 4466 GNI/capita in 2025 to achieve the upper-middle income economy status.[1]

In addition, domestic growth is expected to receive a boost from public infrastructure investment and structural reforms being undertaken by the government. The government has committed to spending 5-6% of GDP on infrastructure projects for the next five years. In 2023, infrastructure spending grew to PHP 1.2 trillion, or 22% of total government expenditure, and PHP 1.5 trillion has been allocated to infrastructure in the 2024 budget. A large proportion of infrastructure is going towards road and rail works, which are expected to support tourism spending in the country. In addition, the government is also looking to pass new legislation that opens public sector projects to foreign investors and encourages greater public-private partnerships in infrastructure.

Separately, the government continues to improve the ease of doing business by streamlining government processes, increasing digitalisation, and placing an increased emphasis on attracting investment into the country to support employment security.

In terms of manufacturing investment, special attention is being given to skills and infrastructure development for the electronics and semiconductor industry, as a strategy to attract more investment in the sector and help orient the economy towards these growing and important sectors.

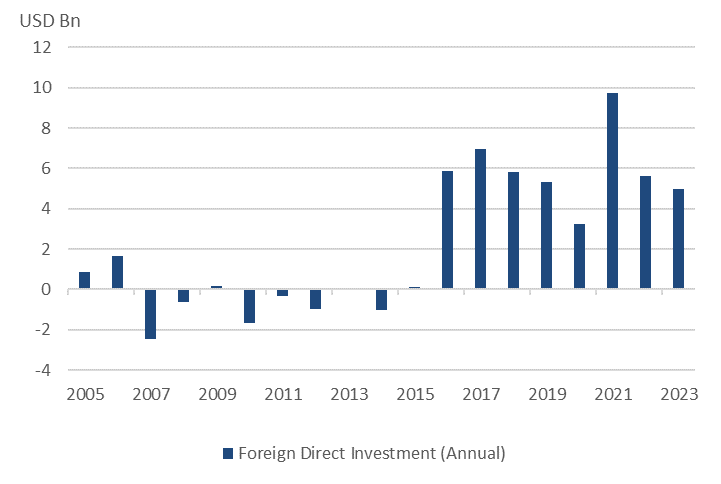

Figure 6: Foreign direct investment into the Philippines has picked up in recent years

Source: Bangko Sentral ng Pilipinas

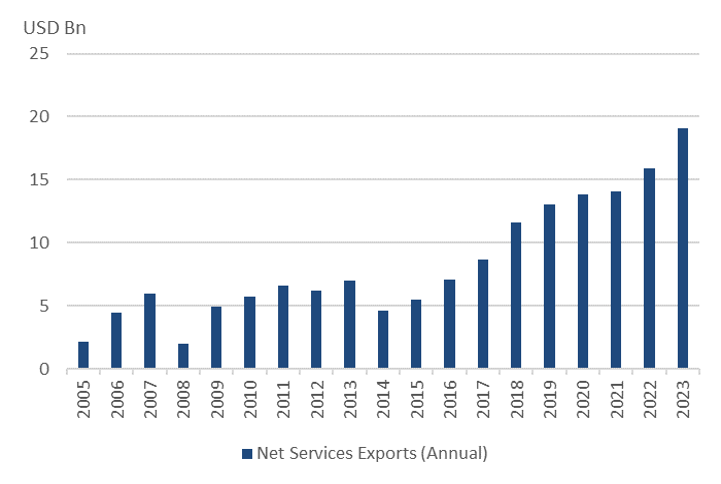

Figure 7: Philippines’ burgeoning service exports sector

Source: Bangko Sentral ng Pilipinas

The Philippines has taken proactive measures to ensure monetary and fiscal policy stability in a time of high inflation. The Banko Sentral ng Pilipinas (BSP) tightened monetary policy early in 2022 but has kept interest rates unchanged since October 2023, providing a real policy rate differential against US interest rates. Meanwhile, the government stepped in with supply-side measures to curb the rise in food prices, which were crucial to taming inflation. This helped contain inflation and provide currency stability through a period of strengthening US dollar.

On fiscal policy, government debt growth has remained disciplined despite rising capital expenditures. Moreover, new legislation has also been introduced to improve tax efficiency – these reforms are expected to improve government revenues and reduce the fiscal debt burden.

Stronger policy frameworks have increased investor confidence

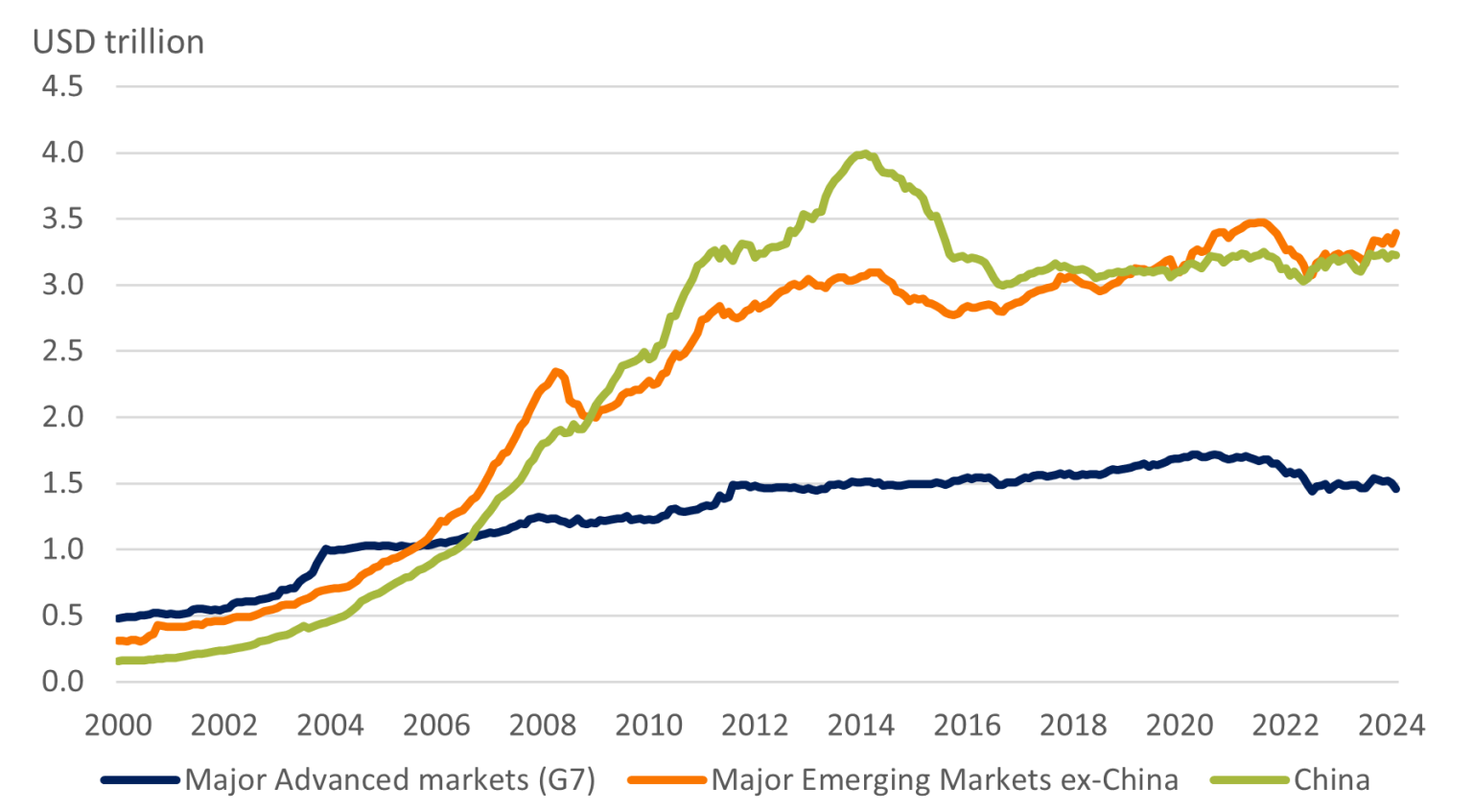

In addition to solid growth and structural reforms, many emerging markets have also proactively strengthened their policy frameworks and built buffers to mitigate the impact of external shocks. These include a build-up in foreign currency reserves, an important consideration for foreign lenders to emerging markets. (see Figure 8).

Figure 8: Emerging markets have built significant foreign currency reserve buffers

Source: CEIC, IMF

Major Advanced Markets include G7 economies of Canada, France, Germany, Italy, Japan, the UK and USA. Major Emerging Markets ex-China include Brazil, Mexico, India, Indonesia, Malaysia, Thailand, Philippines, Saudi Arabia, South Africa, Turkey and Russia.

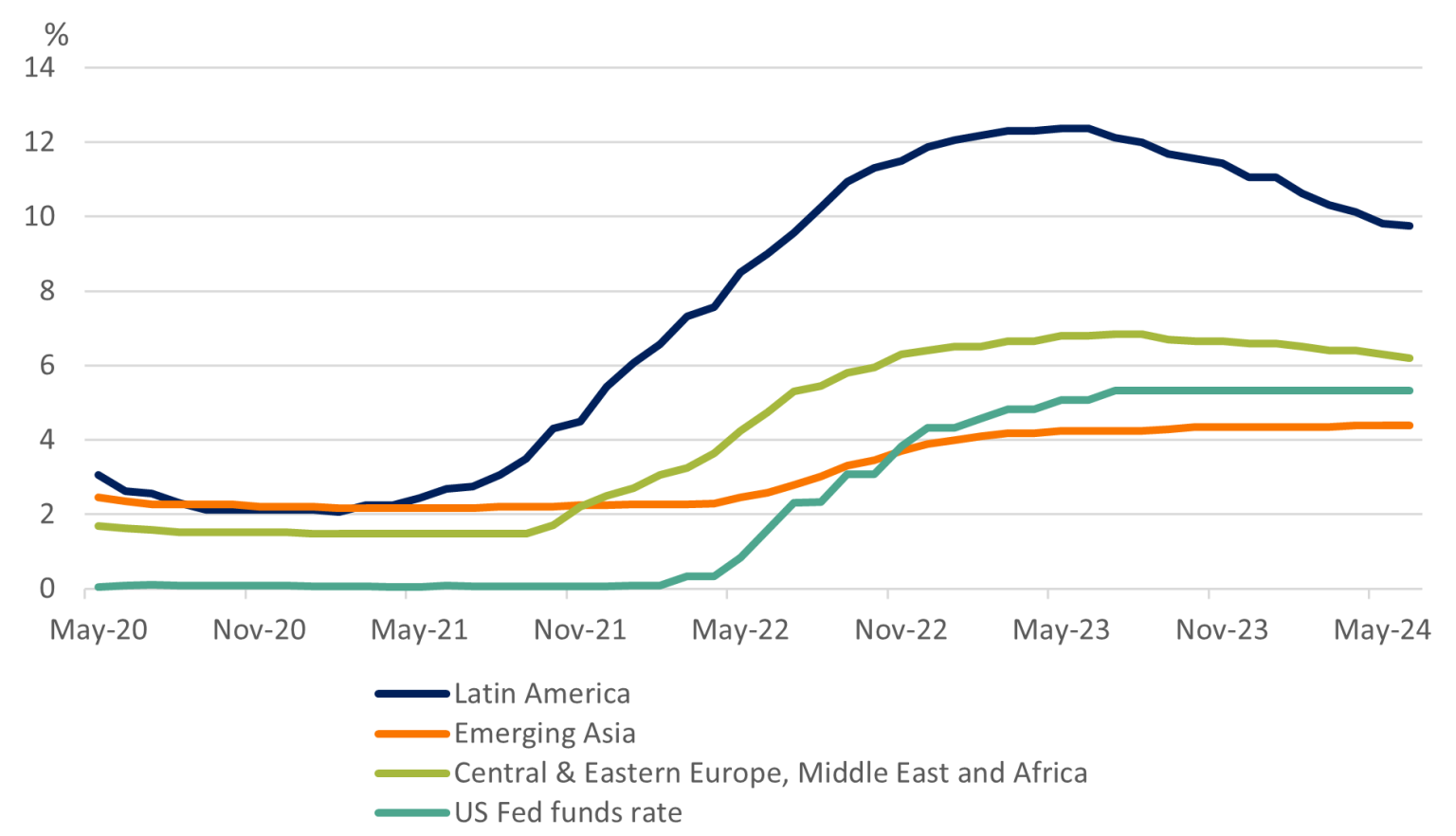

More importantly, greater interest rate policy independence and stronger policy frameworks have led to greater investor confidence towards emerging market central banks’ ability to manage financial stability during turbulent capital shifts. During the inflation increase in 2022-23, we saw many of the emerging markets hiking interest rates even before the US Federal Reserve lifted its interest rates (see Figure 9). This helped proactively increase the yield buffer for emerging market assets versus advanced economies, thus avoiding a disruptive adjustment. Indeed, despite highly volatile markets, in 2022, limited foreign investors were exiting emerging market bond markets. Most investors assessed emerging market economies to remain stable through these periods or trusted the interest rate buffers to be enough for the risk.

Fiscal discipline has also improved across emerging markets. Many emerging market governments kept their purse strings tight throughout the pandemic and post-pandemic periods. Many have even begun consolidating their budgets, conscious of the need to build fiscal buffers for future shocks.

These structural policy shifts have increased domestic savers’ confidence in their markets and reduced reliance on external capital, another key driver for greater resilience. Moreover, predictable and well-defined fiscal and monetary policies have helped keep inflation under control.

Figure 9: Many emerging markets started hiking interest rates before the US Federal Reserve in the recent rate hike cycle

Source: CEIC, Peak Re Calculations

Notes: Average of central bank policy rates for each of the emerging market regions

Summary

The balance of global economic might has been shifting in favour of emerging markets. With strong growth, rising incomes and a burgeoning middle-class, the emerging market economic growth model has become more diversified and resilient to advanced market and global shocks.

Many emerging market economies have also undergone structural and policy reforms to improve their economic and financial resilience. This includes measures to support domestic investment and infrastructure creation and improve the ease of doing business.

From a policy perspective, emerging market economies are reaping the rewards of years of building buffers and pursuing independent, frame-work-driven policies. We believe emerging markets have, over time, reduced their sensitivity to global interest rate changes and avoided a painful adjustment in interest rates and currencies during the current cycle.

Despite addressing many of the past challenges to financial stability and capitalising on rising opportunities from shifts in global trade, emerging market economies need to remain vigilant and proactively develop policies around other emerging risks, such as repercussions from slowing advanced market growth, the impact from slower Chinese growth, the rising debt burdens in the advanced economies, and increasing global geopolitical tensions. Furthermore, most of the improvements were observed in larger and more developed emerging markets. Many less-developed emerging markets have fallen into financial and debt crises over the past years and remain vulnerable to unfavourable external developments.

[1] Steady but Slow: Resilience amid Divergence, World Economic Outlook April 2024, the IMF

[2] India Briefing: Apple’s Contract Manufacturers and Component Suppliers in India, April 2024

with Peak Re