- The policies under the second Trump administration are marked by an intensification of the policies of his first term. In light of heightened policy and macroeconomic uncertainty, financial market volatility has risen significantly.

- While the market has been focusing on the imposition of universal and reciprocal tariffs, the US Presidential policy agenda has more dimensions and implications. Different proposed policies may also have offsetting effects, which makes it imperative that we look at all the proposed policies holistically in order to understand their collective implications.

- Assuming the policies that have been announced remain in force, we expect an overall environment of higher inflation and interest rates, slower trade and GDP growth, and wider fiscal deficits in the US, with spillovers across the globe.

- It should be noted that many of the impacts have been set in motion years ago, including supply chain fragmentation, increased regionalism and diversification of reserve assets from the US. The latest set of US economic policies only accelerates those trends.

Introduction

The scale, speed and unprecedented nature of many of the policy announcements under the new US administration are driving financial market volatility given their considerable economic ramifications. The key socio-economic policies of the second Trump administration could be categorised into four key areas:

- Tariffs and trade barriers: Trade policies are being used to address a range of challenges, including the substantial US trade deficits, a hollowing out of domestic manufacturing capacity, overreliance on foreign sources for critical materials and products, and even as leverage in tackling socio-political issues such as drug trafficking and illegal immigration.

- Tax cuts: Extending indefinitely the Tax Cuts and Jobs Act (TCJA) of 2017, which is set to expire at the end of 2025. Additional measures include lowering the corporate tax rate further from 21% to 20%, with rates of 15% for domestic manufacturers. The tax cuts are expected to be partially offset by increased revenue from tariffs and spending cuts.

- Deregulation: An ambitious agenda to roll back regulations, using the “10 out 1 in” rule[1], that are believed to hinder economic growth, including environmental regulations, labour protections, and financial oversight.

- Immigration: A stringent stance on immigration, focusing on reducing the number of undocumented immigrants and tightening border security.

These policies have overlapping and offsetting impacts on macroeconomic variables, depending on the sequencing, extent and duration of the policy implementation.

For example, unfunded tax cuts are expected to significantly increase US deficits and debt, providing short-term economic stimulus but risking long-term economic drag from higher interest costs. On the other hand, tariffs raise government revenues, but at the cost of lower GDP growth, higher inflation, and heightened market uncertainty. Higher inflation could invite tighter monetary policies, thus worsening debt servicing as well as increasing government spending on social programs. On the other hand, persistent high inflation could, over time, erode the real value of government debt. Table 1 summarises the expected macroeconomic impacts of the major policies.

Table 1: Key US policies and their expected macroeconomic impacts for the US economy

|

US Policies |

Impact on Growth |

Impact on Inflation |

Impact on Fiscal Deficit |

Impact on Interest Rates |

Long-term Impacts |

|

Permanent extension of the Tax Cuts and Jobs Act (TCJA) and corporate tax cuts from 21% to 20%, 15% for domestic manufacturing |

Positive |

Higher |

Significant widening |

Higher |

Unfunded tax cuts over the long-term lead to higher interest payments and wider deficits, worsening debt sustainability |

|

Trade Tariffs and US-China decoupling |

Negative |

Higher |

Reduced fiscal deficit from custom levies |

Higher due to increased inflation expectations |

Reduced efficiencies due to supply chain fragmentation and duplications lead to higher costs for consumers and businesses. |

|

Deregulation |

Positive |

Neutral if growth is driven by deregulation -induced innovation. Could lead to inflation if financial market deregulation leads to excessive credit growth while the economy is near full capacity. |

Potentially higher fiscal revenue if deregulation spurs economic growth |

Neutral |

Potential systemic risks if governance and risk oversight is blindsided |

|

Fiscal spending cuts & boosting government efficiency |

Mildly negative from government spending cuts, potentially low disposable income due to cuts in entitlement programs and loss of employment in the government sector. |

Mildly deflationary |

Mild reduction in fiscal deficit |

Mildly lower |

Will depend on where cuts happen and what measures to boost productivity are put in place |

|

Immigration policies |

Negative mainly due to reduced labour market flexibility |

Higher on margin, due to labour shortages and potentially higher wages |

Neutral |

Higher |

Labour constraints can slow long-run GDP growth, especially for labour intensive industries |

Unfunded tax cuts and the debate on fiscal sustainability

The proposed House-adopted budget resolution allows for USD 5.3 trillion in deficit-financed tax cuts. This includes USD 3.8 trillion to extend the provisions of the 2017 Tax Cuts and Jobs Act (TCJA), and USD 1.5 trillion to enact other corporate tax cuts and other campaign promises such as no taxes on tips, overtime, social security and removal of state and local tax deduction cap over the ten-year budget window.

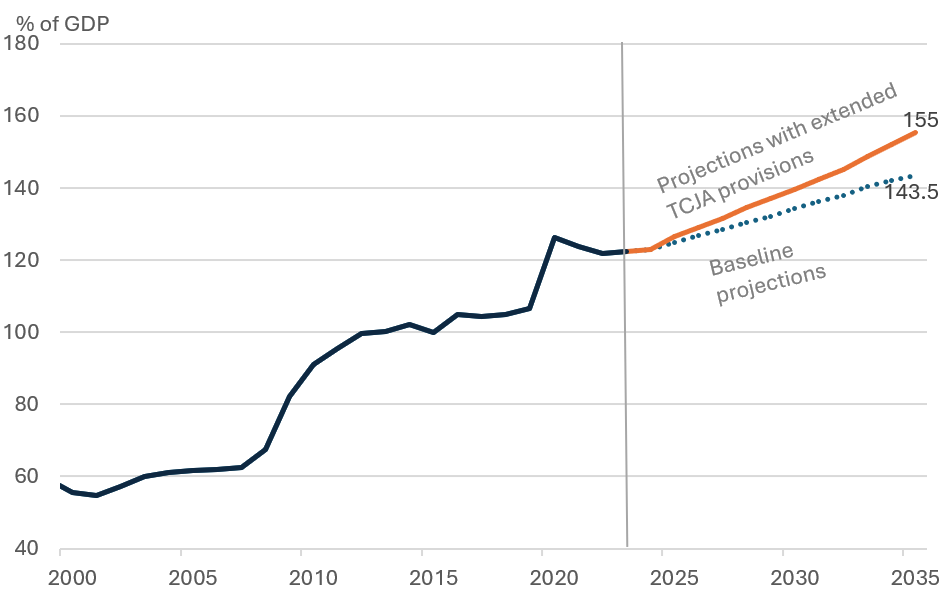

The tax breaks are estimated to increase US debt by over USD 5.1 trillion over the next decade, including interest payments.[2] This is estimated to take US debt-to-GDP ratio from 123% in 2024 to 155% by 2035 (Figure 1). The increment would mark the largest increase in fiscal deficits while the economy is on a strong footing and running on full employment. Concerns over fiscal debts have prompted Moody’s to lower the credit rating of the US to Aa1, from Aaa, on 16 May.[3]

If passed, the tax cuts are expected to give a stimulatory boost to the economy in the short run. The Congressional Budget Office (CBO) estimates that the TCJA extension would add 0.3% to the US GDP by 2027, while other estimates range to as much as 1.1% increase in GDP[4].

However, rising deficits create a long-term drag on growth, pushing up interest rates, crowding out private investment and slowing productivity growth. The CBO estimates that if tax cuts are not offset, it could contract the economy by 0.8% to 1% by 2044, depending on the increase in interest rates from the higher deficits.

The US administration expects the tariffs on US imports to offset the revenue decline from tax cuts. Here, these estimates differ significantly. The Tax Foundation estimates a 10% universal tariff on all imports to the US to bring in about USD 2.2 trillion in revenue over ten years, while contracting long-run GDP by 0.8% (without considering tariff retaliation from other countries). Other estimates suggest that if the “liberation day” reciprocal tariffs were added, it could bring up to USD 5.2 trillion in tariff revenues over ten years[5], offsetting the revenue loss from tax cuts.

Seen together, the proposed tax cuts are likely to stimulate demand in the short run, but may risk fiscal sustainability and long-term growth. The use of fiscal stimulus in an environment of already strong economic growth also risks running inflation hot and reduces fiscal space to respond to future economic shocks.

Debt affordability is expected to worsen at a faster rate as interest payments on debt increase sharply, accounting for 30% of fiscal revenue by 2035 compared to 9% in 2021.[6] This is likely to increase the risk premium on US Treasuries. This, instead, increases the borrowing costs within the US, and makes USD-denominated debt more expensive, globally.

Figure 1: US debt to GDP ratio expected to rise steeply with unfunded tax cuts vs baseline

Note: The projections use the debt held by public to GDP projections from the CBO and assumes debt held by government account remains constant at 25% of GDP.

Source: Office of Budget Management, CBO projections, CEIC

Tariff policies stoke concerns of an inflationary recession in the US

The significant hike in US import tariffs - 10% universal tariffs, as well as other sector and country tariffs - are among the most consequential policy changes, with significant impacts for the US and the global economy. The “reciprocal tariffs” announced on 57 economies have been put on pause, and could potentially be a negotiation tool, but risks of re-escalation remain. We delved into some of the effects of the tariffs in our Global Economic Outlook.[7]

The tariffs, depending on the extent implemented, are expected to raise between USD 2.2 – 5.2 trillion in federal revenue over the next decade, but with significant impacts on global trade, GDP growth, inflation and investment.

In its first order effects, tariffs increase input costs for the US consumer and businesses, affecting consumer disposable incomes and business margins. As a result, consumption, the driver of strong US economic growth over the past few years, is expected to falter.

In second order impacts, as trade deficit shrinks, foreign purchases of US debt decline, forcing US households to hold more of the debt, diverting savings away from investment in productive private capital. Moreover, heightened economic uncertainty can paralyse investment decisions and disrupt supply chains.

From a global lens, slower global trade is expected to adversely impact export-oriented economies. In this respect, Mexico, the largest import partner of the US, is expected to see its GDP growth stall this year.[8] The IMF projects Canada’s growth to slow to 1.4% from 2% projected earlier and China’s GDP growth to soften to 4%.[9] Within emerging Asia, Vietnam and Taiwan are most exposed in terms of their trade ties with the US, while the open, heavily trade-reliant economies of Singapore and Hong Kong will be vulnerable to a slowdown in global trade.

Beyond the tariffs, a significant escalation in the US- China trade war is a greater risk for the global economy. Long term competitive drivers and frictions between US and China are likely to remain no matter the leadership. However, the recent tit-for-tat 145% tariffs on Chinese imports to the US, and 125% retaliatory tariffs on US imports to China is an example of severe escalation that effectively created a stand-off for USD 585 billion of annual global trade. Bilateral frictions are expected to drive continued economic fragmentation, increased regionalism and self-dependence, and significant changes as well as duplications in the global supply chains.

Immigration policy could strain labour-intensive industries

As a key campaign promise, President Trump’s administration has acted quickly on immigration policy, including mass deportations of undocumented immigrants. Campaign promises suggested deportations of 15-20 million illegal immigrants, and the official number of undocumented workers in the US is close to 11.7 million[10], or about 6.5% of the US labour workforce. If deportations take place at the scale suggested, it could shock the labour markets, constraining capacity in labour intensive industries, and potentially risking a wage-price spiral.

Meanwhile, US Immigration and Customs Enforcement (ICE) data suggests the deportation numbers so far have been in line with those seen under previous administrations, and could likely add up to about 500,000 annually, i.e. about 0.2% of the labour force. However, it also reports record-low border crossings into the US, implying that the deportations are unlikely to be offset by incoming immigrants, which could add to labour supply constraints.

Tighter labour markets could disproportionally affect selective industries with low skill-barriers-to-entry such as construction and agriculture, stoking wage pressures for these industries.

Deregulation boost for businesses in the near term, but raises long-term vulnerabilities

Measuring the macroeconomic benefits of deregulation is difficult, while it draws caution on its long-term impacts. Studies[11] suggest that deregulations that focus on reducing barriers to entry for products and businesses support investment, innovation, competition and improve consumer benefits. On the other hand, lack regulatory oversight could harm businesses and individuals in the long term by encouraging anti-competitive and risky behaviours.

The administration’s “10 out 1 in” rule on deregulation aims at reducing compliance costs for businesses. A study by the National Association of Manufacturers[12] estimates that regulatory compliance costs US businesses USD 1.7 trillion or about 19% of payroll expenses. A reduction in regulatory costs is particularly favourable for small businesses. In addition, an easing of labour regulations should improve labour market efficiency.

In energy, reduced regulation could boost energy supply though gains may be reduced by the ongoing trade frictions and potentially lower global growth. In the automobile industry, changes in emissions standards may alter production processes and lower costs. In housing, cutting regulatory costs for homebuilders and releasing federal lands for construction could improve housing affordability.

In the financial sector, easing regulatory oversight, lowering bank capital requirements through softening stress test scenarios, potential changes to Dodd-Frank rules and/or delays in Basel III, as well as lowering restrictions for mergers of large companies, are likely to encourage credit availability and M&A activity. Cryptocurrency and fintech are also expected to get a boost from easing financial regulations.

On the other hand, mass layoffs and budget cuts for federal supervisory agencies may compromise the oversight and disaster response function of these agencies, potentially increasing systemic risks. The US deregulation strategy also risks increasing fragmentation of global governance, if the largest economy increasingly does not endorse global standards and agreements (such as the Paris Agreement and Basel III implementation). This could also drive global competition for lower regulation and less global cooperation.

Summary

The combination of the major economic policies under the new US administration, including higher trade tariffs, tighter immigration and tax cuts could likely drive inflation higher, derailing the disinflation path in place since its peak in 2022. This could potentially feed into higher interest rates. Moreover, tariffs, policy uncertainty and supply chain disruptions are likely to drag down US GDP growth. In part, these effects may be offset by a boost to the domestic economy from the TCJA extension, corporate tax cuts and for certain industries and deregulation. We may also have to consider the possibility of policy reversals as the economic costs rise, and that the Federal Reserve might come to rescue by lowering interest rates if the economic drag is significant.

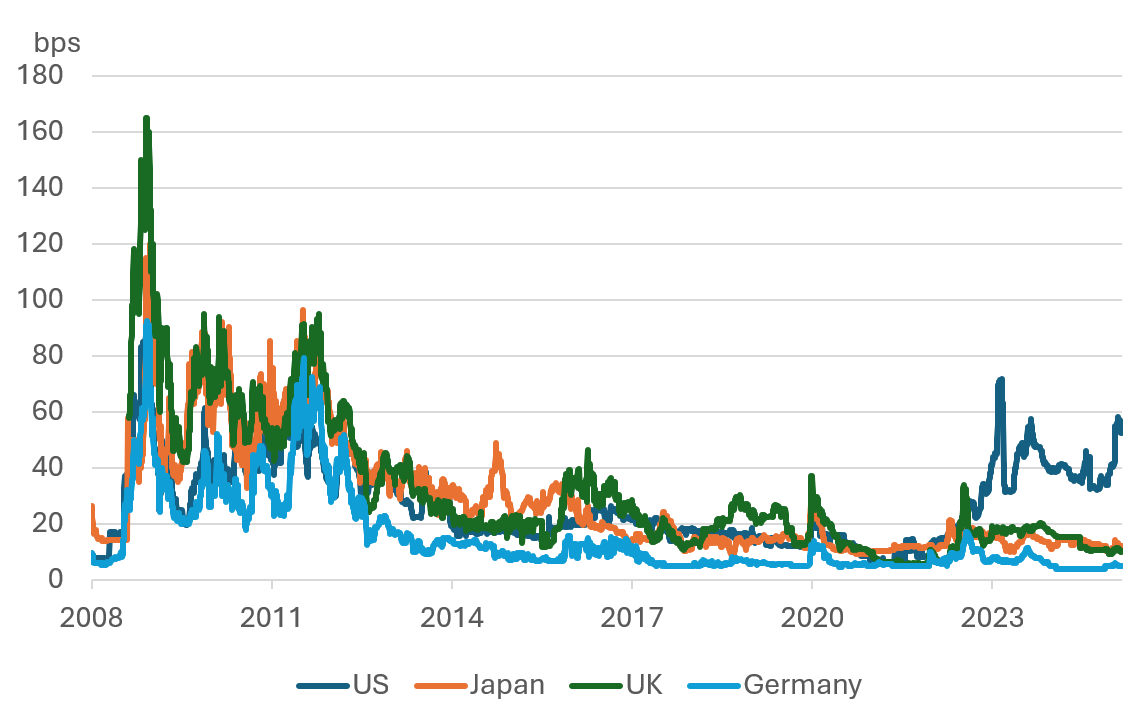

The current trajectory suggests that US fiscal deficits could widen more than the baseline due to the proposed unfunded tax cuts, while inflation and slower growth could potentially further complicate the fiscal outlook. Deteriorating debt dynamics have already been feeding into elevated credit concerns for the US economy, even before the new tax cuts are introduced. Following the action from Moody’s on 16 May 2025, US sovereign debt has been downgraded one notch below AAA by all three credit rating agencies, citing rising fiscal budgets and ballooning interest costs. Higher risk premiums for the US are also reflected in elevated CDS compared to other major economies (Figure 2).

The credit concerns could undermine confidence in the US as the global safe haven and reserve asset, which along with other geopolitical considerations, may accelerate the ongoing diversification of global reserve assets. To be fair, there are no clear alternatives to the US reserve asset, which provides unparalleled depth and capital convertibility for global investments. There are also many mechanisms the US has to address the rising debt, including budget reforms, money printing, inflating out of the debt, financial repression to contain interest costs, or reducing its current account deficits. However, unless political consensus can drive significant changes, a slow erosion of trust in US assets can continue to raise risk premiums on US markets and with it, borrowing costs for USD assets globally.

Figure 2: US 5Y CDS is elevated compared to other major economies

Source: LSEG datastream

[1] By an Executive Order, whenever an US agency promulgates a new rule, regulation, or guidance, it must identify at least 10 existing rules, regulations, or guidance documents to be repealed. Fact Sheet: President Donald J. Trump Launches Massive 10-to-1 Deregulation Initiative – The White House.

[2] Other estimates suggest a range between USD 5 trillion and USD 11.2 trillion. See Trump Tax Priorities Total $5 to $11 Trillion-2025-02-06, Committee for a Responsible Federal Budget, 6 February 2025.

[3] “Moody’s Ratings downgrades United States ratings to Aa1 from Aaa; changes outlook to stable”, Moody’s, 16 May 2025.

[4] Tax Foundation: Making the Tax Cuts and Jobs Act Permanent: Economic, Revenue, and Distributional Effects, 26 February, 2025

[5] Penn Wharton Budget Model: The Economic Effects of President Trump’s Tariffs, 10 April, 2025

[6] The Business Times: Moody’s: US fiscal strength on course for continued decline, 25 March 2025.

[8] Reuters, Mexico economy to barely grow this year thanks to US tariff shock, 28 April 2025

[9] IMF World Economic Outlook, April 2025

[10] Center for migrations studies: US Undocumented Population Increased to 11.7 Million in July 2023, September 5, 2024

[11] National Bureau of Economic Research: Working Paper No. 9560, How Deregulation Spurs Growth, March 2003

[12] The Cost of Federal Regulation to the US Economy, Manufacturing and Small Business, October 2023

Disclaimer

Peak Re provides the information contained in this document for general information purposes only. No representation or guarantee is made as to the accuracy, completeness, reasonableness or suitability of this information or any other linked information presented, referenced or implied. All critical information should be independently verified and Peak Re accepts no responsibility or liability for any loss arising or which may arise from reliance on the information provided. All information and/or data contained in this document is provided as of the date of this document and is subject to change without notice. Neither Peak Re nor any of its affiliates accepts any responsibility or liability for any loss caused or occasioned to any person acting or refraining from acting on the basis of any statement, fact, text, graphic, figure or expression of belief contained in this document or communication.

All rights reserved. The information contained in this document is for your information only and no part of this document may be reproduced, stored or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of Peak Re. Any other information relating to this document, whether verbal, written or in any other form, given by Peak Re either before or after your receipt of this document shall be provided on the same basis as set out in this disclaimer. This document is not intended to constitute advice or recommendation, and should not be relied upon or treated as a substitute for advice or recommendation appropriate to any particular circumstances.

© 2025 Peak Reinsurance Company Limited.

with Peak Re